Hope you comment!

Read this post at forex factory on The Sound of Price

This post may also be helpful – How to Get Forex Quotes from MSN into Amibroker

If you use IB, Amibroker, and TWS to trade Forex, chances are you have been confused with the data feed from IB. Yu might have asked yourself “How do I get daily data from MSN and mix it with intraday data from IB on the same chart?” I hope you didn’t answer yourself, at least out loud!! You could enter EURUSD as a symbol in Amibroker and download daily data from MSN. Then you could enter EUR.USD-IDEALPRO-CASH as a symbol so you can trade it from the Amibroker charts using Tipster Trendlines. But the silver bullet would be to have both data sources on the same chart, and be able to use that chart to place and modify orders.

Why would anybody want to do this? Because I trade Supply and Demand zones and I always look at the weekly and daily zones. They tell me where I am in the universe. Placing a trade with only 1 month of data is not a good idea, its a bad idea.

This is how you do it.

Goto: File->Database Settings->Intraday Settings and make sure “Allow mixed EOD/Intraday data” is checked. See below.

Then enter a new symbol EUR.USD-IDEALPRO-CASH and delete the symbol EURUSD if it exists. If EURUSD exists, the data from MSN will go to that symbol and not where we want it to go.

Goto: Symbol->Information and enter the inputs below

Alias: EURUSD

You can also enter the ticksize and point value, this is helpful if you are using TipsterTrendlines.

Save you work: File->Save ALL

Turn off the data feed from IB TWS or close TWS (bottom right corner of Amibroker, right click, select Disconnect)

Open Amiquote Tools->Auto update quotes

Select the dates – try to load one year to start with. If you select to much data it will not work. You can do something like 2 years at a time to get a large database.

Select MSN Historical as the data source

Make sure Automatic Import is checked.

Start it by pressing the green triangle on the menu

After it finishes, click on EURUSD in Amiquote to make sure the data was downloaded, a text box will open showing a bunch or quotes.

Then go to Amibroker and select daily timeframe for EUR.USD-IDEALPRO-CASH and you should see a huge chart.

Turn on the TWS data feed.

Then select the smallest timeframe and you will see data from IB, streaming.

You might notice that you can see daily data back more than 3 months but if you switch to hourly you wont have that much data. The IB data feed length depends on the number of days to download and the period you selected for the IB database in the database setup. This should be enough o get you started.

If you use Amibroker, I suggest you check out TipsterTrendines, the current users love it. It sends your order instantly based on line you draw on the chart. It’s a cheap solution compared to entering the wrong numbers in TWS.

Hope this help. Spread the word in the forums.

Here’s a toy a recently purchased. An FM transmitter. Now I can listen to my tunes all over the house in great quality.

I use winamp with 2 plug-ins to make the transmission sound better than the local radio stations.

Here’s a pic of the back of the board after I had to do a mod to the board.

I have stopped trading the USD/JPY. If you look at the chart you can see it’s flat lining with no price swings. Take a look at the ATR on different time frames, the intraday isn’t that great either.

The average weekly range was around 430 points just prior to 2009, and since then it has fallen lower and lower, and now stands at a 117 points PER WEEK. The average daily trading range has often been in the 50-60 points region, sometimes more, but it has dropped off sharply to what must be close to an all-time low of just 31 points.

It is probably best to concentrate on the other major currency pairs instead, such as the GBP/USD and EUR/USD pairs for example, but watch that EUR slide!!

Here’s a really easy way to format your code. Formatting code makes it easier to read the logic flow, this little program automatically indents, fixed spaces and tabs. After my EA's get to big and add the debugging to the mix, my formatting starts to slowly go out the window. I run this every now and then, it takes under 30 seconds. This is a command line formatter.

Go get the file from here or here

These links take you to http://astyle.sourceforge.net. The page at one of these links will describe the switches you can use with the command line formatter. I've chosen some that work for me to get your started.

Instructions

1. unzip and find a file called AStyle.exe (windows) in the “bin” directory

2. put the file in the experts directory

3. open up a command prompt window (start>run>cmd)

4. drag the AStyle.exe file into the window

5. add a space then type this after the file name -A2 -s3 --mode=c

6. Add a space then drag and drop the file you want formatted, press enter

7. Done. You see the original was renamed with a “orig” extension.

How easy is that!

Ever since MF Global went tis up, I’ve been on the hunt for a new broker.

Here's my deal;

I use Interactive Brokers, they don't do MT4 though.

I had an account with MF Global, through their Canadian office who were members in the Canadian Investor Protection Fund (CIPF). When they went tits up I didn't have to worry, the CIPF covered me 100% up to a million bucks, I got my full $$ back in the form of a cheque with the help of the courts and KPMG.

Then, I opened a mini account with Oanda a while back, found out they don't allow MagicNumbers and they write a reference number in the comment field. Never thought to check the demo account, I mean why would a criminal do something stupid like like?? Live and learn boys and girls. They suck because of that, money is being withdrawn. Losers.

After MF Gobal

So now I needed a new criminal....

Rather than reading reviews, I first started looking for a criminal that actually had what I wanted, a little tougher here in Canada. I want a criminal to be CIPF registered. I found thehttp://www.friedbergdirect.com/ only by asking FXCM if they had a Canadian office. When I was using MF Global, they used Boston Technologies for MT4 as do FXCM. So I think I'll be OK with FXCM, I'm going trough the Canadian criminal, Friedberg Direct. Account opening is in progress.

I opened an account with PFGBest a while back, funding is in progress.

I called IBFX to ask them a bunch of questions and fill out my "criminal research sheet" and they said, since TradeStation acquired them, they don't accept Canadians. Now I hate TradeStation even more than I did 6 months ago. They are scared of Canadian regulations, they can go f*#% themselves.

In the end this is how I want my accounts to be setup:

Interactive Brokers - trade ETF's (index) longer term and some futures (Asia)

FXCM - 0.01 lot size - EA's that have proven to be profitable and bug free on demo are promoted to this account on a low risk setting, trading Live. One reason for this is I notice demo services puke quite often, all kinds of errors and order time outs at normal times of the day. If this account makes $$ I transfer to an account with larger lot sizes. They also offer to reimburse for VPS, account minimum has to be met. I use my home PC right now with cable modem and low downtime - Pentium 4 humming along running 4 MT4's at a time, each with between 3 and 10 charts open.

PFGBest - lot size 0.1 - use for EA's that have graduated and proven themselves to be bug free and profitable. They have a Canadian office but I elected to use the US office and also trade futures. I'll probably change this to the Canadian office and ditch the option to trade futures. Still pondering this.

I’ve almost settled and I’m pretty sure I’ll be OK with PFG and FXCM. I want two separate brokers with 0.1 lots and 0.01 lots. When an EA show promise on demo it graduates

I thought I would offer an update on this code. The code might be "old" but it sstill works and I still use it.

This code allows you to place trades and modify trades right from the Amibroker chart. It has much more functionality than the current version of Amibrokers trading off the chart feature. Watch the video and see for yourself.

Here is the link to read more about this and get the code. Tipster Trendlines 3

Tipster Trendlines 3 from Another Brian on Vimeo.

This AFL code for Amibroker allows you to place trades right from the Amibroker chart. Once the order is place (transmitted) you can change it just by moving the 3 lines on the chart and pressing the button on the chart window. Once the order is filled, you can move the target and stop lines and press a button the change them too! All you have to do is draw 3 horizontal lines on your chart and you're ready to trade. Watch the video to see how it works.

http://blog.tipster.ca/p/tipster-trendlines-3.html

Alpari UK started up this years forex contest. It's free and offers 20K of prizes.

I've already signed up for it, under the name AnotherBrian, account number 28353.

If you want to see where I stand in the league table, here is the link, enter the account number in the search box.

Here's the link to register.

Alpari Forex Contest

Good luck!

So I made a system a while back for MT4, based on support and resistance. I backtested it and studied it to learn the strenghts and weakness. I've been demo testing it for about 4 months with good results, its not the grail but it trades without causing platform errors and long term produces some gains.

On MTI Live, it was running on Anotherbriandemo, you can see it in the comments of the published statement on the MTI site. It's now running on my real account. I've adjusted the published statement start date of the Anotherbrian MTI Live account to be the same time I started using it. I also use two other trading strategies on this account. ForexMorningTrade and dicretionary trading based on Sam Seiden.

FMT - I use this as more of a scalper with small lot size - this is like a real account test - I didnt back test it. I watch it the day it trades to see if I should close it or not.

Sam Seiden - I usually use a 1 or 4 hour chart for this. This strategy requires patience. In order to help me with that, I found having a robot running kills most of the urge to trade, so I can wait as long as it takes.

So, time will tell.

See the right side bar for performance or visit these links

Demo MTI Account

Live MTI Account

For the longest time I've been breakeven or losing slowly. For the past severla months I've been working on EA's and watching them, and trading myself. I think I found what works for me, as overtrading is a problem. Let's see what happens!! Join the MTI competition for some fun.... it's outlined in the post below.

UPDATE (July3, 2011): The MTI Live website doesn't seem to show things as they really are unless you include ALL history. I haven't figure it out yet (how to correctly show stats from a certain day forward).

The Tipster SR EA is LIVE. It's one of the 3 EA's running on my live account.

This is a re-post. The first competition had some technical issues with the rules I set up so I stopped it and created another one. Join in!!

If you use MT4 (or MT5) and trade forex I invite you to join this free contest. The winner gets bragging rights.

I use MTi to track my performance of both live and demo account. My demo account is running a robot and MTi allows me to see the trade stats. They recently added a new feature called "Competitions". I've started a new competition and I invite you to participate. It's called "Calling All Robots"

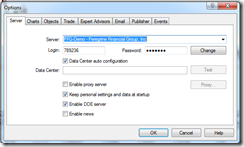

To enter you need MT4, and an account with MTi. It's easy to sign up. Once you've signed up you download this and install, it installs automatically. You disable the FTP feature in MT4 options as this new file will upload all the trades to MTi. It's pretty slick.

The competition is scheduled to run from Fri, 27 May 2011 14:08 GMT to Wed, 1 Jan 2020 16:00 GMT

Basically, forever!

Rules The competition is open to both live and demo accounts.

What happens when a countries bank intervenes on the currency market? This happens...

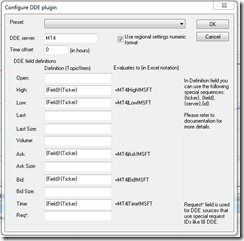

I've written Tipster Trendlines for MT4 that attempts to model the original version for Amibroker. MT4 doesn't allow many of the features I've implemented in Amibroker but it's a lot less coding too, so that offsets the pain of coding. For example, it is very difficult to place buttons on the chart, so I tried using hot keys, and that didn't work.

Just in case you weren't aware, there is a FAQ on Tipster Trendlines.

Here's the link

Tipster Trendlines FAQ

I finally found a source for free forex data that is complete, and FREE!

Here is the link to the file - Metatrader Free Forex Data

And the recommended set-up to back test your EA on MT4, follow this link

Set up for back test

There are other helpfull articles on that website also. I took a look at the two systems they are offering for sale and they don't fit my style. I like smooth equity curves. One of the systems has a 30% win rate, I like small gains with high win rates.

Last week I caught a big move and rode it for a nice profit. It was the breakdown of EURUSD below 1.3450 area (support area on the daily chart and also going back to May 2009). Now its getting back to that area (revisiting, support becomes resistance) and I'm considering shorting again. The only thing that looks odd is the speed at which it has re-visited the area. It doesn't look so odd on smaller time frames. With proper risk management and appropriate stop placement this is worth a go since the reward (profit area) is quite far away when looking at the daily chart, 1.2900 area. Here's the chart... as I see it.

Here's the hourly picture. Watch out for early Sunday fake outs, including gap plays.

Here is an example of a scan I'll do when I'm looking for a swing trade on the TSX. The output window is shown below, along with a few stocks that i would consider entering on STOP orders, all are long entries.

The coloumns I generally look at in the output window are;

I use Tipster Trendlines AFL code for Amibroker to place my trades. It's a great tool to place the trade right from the Amibroker chart. Interactive Brokers is who I use.

The new code is in beta testing.

The goal of the new code is to never have to see TWS again!

New features include;

Anyone that has previously purchased earlier versions will be sent the code via email once it is ready.

Here is a handy tool if you use Bracket Trader (BT). This excel file will extract information from your BT log files to give you trading stats. Take a look at thew different stats it tracks.

Bracket Trader Spreadsheet

The instructions are good, so no need for me to explain how to use it.

... after reading the title of this post you're probably thinking that I made an e-boook and I'm giving it away for free. Not. Maybe one day. I want to give you another hint on finding books.

Earlier I wrote about finding free e-books using Google "Free ebook for everyone - how to find free books online". Go to that post and read the instructions, and become familiar with Googles advanced search.

A while back I read this post by RiskAddict "Example Trading System" and went to the link he provided to download the e-book. It wouldn't let me get the book, something about maximum limit reached. So I went up to the Google tool bar and typed in "book" and selected "search site" from the Google drop down menu. From there I browsed through the hits and selected the PDF.

Here is the link that Google spit out, download the PDF while it's still there - How to develop a futures trading system ebook

10 tips from the website with the book;

fear and greed influence your trading decisions.

There are two ways to backtest that I know of using Amibroker;

Use the backtester

use the playback feature

Backtester - This requires some coding, coding that isn't required when trading live with Amibroker, Bracket Trader, and TWS. You have to watch out for a whole basket of different issues that can creep into the test. It remains a valuable tool.

Playback simulation - This is a great tool for practicing discretionary trading. It's also a great tool for testing your Bracket trader (BT) interface / system. If it would just work! I searched high and low and the net for some information on how to do this, or code that I could simply drop into Ami that would "make it happen". The good news is that I've finally got it to work, and surprisingly it wasn't to difficult to code, but getting the bug out was an issue.

Ive used it to test several days of 1 minute HSI system with BT to get the stats from it. The last thing I just completed tonight was exiting positions near the close. Still a few issues to work out with that. Still, the most difficult part is finding a system that generates a profit, I'm looking for a winning ratio of 40% or better.

Is anyone else using Amibroker playback in this fashion?

I was contemplating doing a video on this and posting the code. Not sure I want to spend the time to do it though.

I've been searching the web for blog posts and forums to gain insight into the HSI. It seems some of the comments are dated. If you trade this I'd appreciate any feedback or information you can offer (what doesn't work, what works) from your experience. Here is what I have learned thus far;

It's technical intraday chart looks very technical and normal, the daily looks like its on crack, gapping all over the place. The opening gap break out seems to work well, gap and run. I've been using the first 5 to 8 minutes to gauge the direction and strength. Then I bottom fish and take the breakout for my position and let it ride. Last night worked perfect, huge gains, sold when the upwards trend line broke.

I also only trade the "morning session" up to about midnight EST, then its bedtime. The "afternoon session" seems to have a mind of its own, like a different day.

The first half of the morning session moves and trends, the second half can be choppy, the range (ATR) increases too. Just before each session closes the price goes nuts.

I've read that the market is heavily manipulated by technical traders? I'm not sure what that means, it looks like it has some structure on the 1 minute time frame.

Questions for you if you trade this;

Definition

"Volume Weighted Average Price. A measure of the price at which the majority of a given day's trading in a given security took place. Calculated by taking the weighted average of the prices of each trade. The method is used by institutional traders, who often break a given trade into multiple transactions."

Another definition

The VWAP for a stock is calculated by adding the dollars traded for every transaction in that stock ("price" x "number of shares traded") and dividing the total shares traded. A VWAP is computed from the Open of the market to the market Close, AND is calculated by Volume weighting all transactions during this time period.

VWAP, or Volume Weighted Average Price is a tool used by some traders, I first learned of it from Brian Shannon who trades stocks. This won't work for forex since there is no volume.

There are a few different ways of displaying this in Amibroker. It can be a simple line like a moving average, this is the most common way pro's use it. Amibroker has a function to display it behind price, look in the help for these two functions with examples;

Most nights I'm trading EURUSD or HSI (mini Hang Seng). Tonight I'm in the chat room mentioned in an earlier post. Join me if you like. Tonight I'm looking at HSI. IB symbol for Amibroker is MHIV9-HKFE-FUT-HKD

CHATROOM

I was contemplating using twitter as a chat medium but I haven't explored it much or used it. Stocktwits is also a possibility but again I don't know much about it. Any comments on it's use compared to a chat room would be beneficial. Also, are any readers interested in chatting in the evening?

The last post on EURUSD talked about some basics and a short update as price was playing with the trend line. I am currently long and I plan on holding for the ride.

WEEKLY CHART From the weekly chart we can clearly see that price has entered an "air" zone, there is no meaningful resistance on the way up to the top of the yellow box.