Saturday, December 29, 2007

Dec 29 Trends

Friday, December 28, 2007

Price Patterns

Here's a simple video on price patterns. It's about the most straight forward one I have seen. It's from a great web site called "Profiting with Forex"

Sunday, December 23, 2007

The TREND Scan

A while back I posted this Post. Now I want to know how exactly to interpret what the table was telling me. So I ran the scan for a few months back to see the story the table was telling, and then looked at what happened on the charts. Then I searched for and read the Livermore trading rules. I'm going to take a stab at this with the little research I've done (no back testing etc., just looking through charts to figure out how to use the table).

Here is the scan I ran today on the FOREX market.

Here is what I would do (simulated trading exercise) -

Short all the rows with 3 RED cells except for GBPNZD and GBPCHF. I don't really like the looks of GBPAUD but it looks like it will go red based on the H&S pattern it has completed today, so I would probably short that as well. The prices I would use to short would be based on interday charts but for this exercise, lets say its half way between open and close of the day before. Trailing stops would be the high of the day before.

Long all the rows with 2 GREEN cells. Buy price would be halfway between the open and close of the previous day (or no entry). Trailing stops would be the low of the day before.

I'll record these and see what happens. I wonder what the holiday season trading will be like, if the price levels will be impacted. I figure the volatility will be low.

More info on the screen rules.

The screen is based on the Livermore rules; below is an except from a web site on this trader.

All successful stock and commodity traders have rules for buying and selling. Many traders today still use the trading rules Jesse Livermore first devised almost a century ago.

Jesse Livermore constructed his rules over several years while he learned by trial and error what worked on the markets. He was guided by one of his favorite principles:

"There is nothing new in Wall Street. There can't be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again."

Trading Rules

- Buy rising stocks and sell falling stocks.

- Do not trade every day of every year. Trade only when the market is clearly bullish or bearish. Trade in the direction of the general market. If it's rising you should be long, if it's falling you should be short.

- Co-ordinate your trading activity with pivot points.

- Only enter a trade after the action of the market confirms your opinion and then enter promptly.

- Continue with trades that show you a profit, end trades that show a loss.

- End trades when it is clear that the trend you are profiting from is over.

- In any sector, trade the leading stock - the one showing the strongest trend.

- Never average losses by, for example, buying more of a stock that has fallen.

- Never meet a margin call - get out of the trade.

- Go long when stocks reach a new high. Sell short when they reach a new low.

- Don't become an involuntary investor by holding onto stocks whose price has fallen.

- A stock is never too high to buy and never too low to short.

- Markets are never wrong - opinions often are.

- The highest profits are made in trades that show a profit right from the start.

- No trading rules will deliver a profit 100 percent of the time.

Saturday, December 22, 2007

The Holiday Season

Thursday, December 20, 2007

Saturday, December 15, 2007

How to get FOREX quotes from MSN into Amibroker via Amiquote

Amiquote is equipped with an automated download of FOREX from FORAM but only has the majors. I''m interested in USDCAD so this isn't the best solution for me. Yahoo seems to offer only current day. So I tried MSN. I used MSN to download EOD FOREX data and noticed that the USDCAD pair was inverted, as was the CADUSD pair. So I went the next step and obtained a list of currency pairs. I'll list the pairs and then some instructions on how to configure Amibroker/Amiquote to auto download. Some pairs included here are useless, so you might want to trim your database once you've completed this. Then I configured the Amiquote translation table to relate the proper data to the symbols the way it should look. Here are the instructions on how to do this.

Here are the pairs, import this list into Amibroker. Import using "Import Wizard" select the file and set the window up like this screen shot.

Now you have a populated database in Amibroker, but it's empty. Next, click "Tools" "Auto Update", Amiquote opens. Select MSN as the datasource. In AMiquote Select "Tools" Symbol Translation", select "MSN Historical" and copy the following list to the clipboard and paste into the translation table in Amiquote as shown below. Hit OK and select the dates you want to import, then start the download. If you go to far back it will only give you monthly data, so do a long term and then a short term download. You can even try to get data for something like 2005 to 2006 and see if it give you finer resolution.

Copy this list into Amiquote translation table for MSN

AUDCAD,/CADAUD

AUDCHF,/CHFAUD

AUDEUR,/EURAUD

AUDGBP,/GBPAUD

AUDHKD,/HKDAUD

AUDJPY,/JPYAUD

AUDNZD,/NZDAUD

AUDSGD,/SGDAUD

AUDUSD,/USDAUD

CADAUD,/AUDCAD

CADCHF,/CHFCAD

CADEUR,/EURCAD

CADGBP,/GBPCAD

CADHKD,/HKDCAD

CADJPY,/JPYCAD

CADNZD,/NZDCAD

CADSGD,/SGDCAD

CADUSD,/USDCAD

CHFAUD,/AUDCHF

CHFCAD,/CADCHF

CHFEUR,/EURCHF

CHFGBP,/GBPCHF

CHFHKD,/HKDCHF

CHFJPY,/JPYCHF

CHFNZD,/NZDCHF

CHFSGD,/SGDCHF

CHFUSD,/USDCHF

EURAUD,/AUDEUR

EURCAD,/CADEUR

EURCHF,/CHFEUR

EURGBP,/GBPEUR

EURHKD,/HKDEUR

EURJPY,/JPYEUR

EURNZD,/NZDEUR

EURSGD,/SGDEUR

EURUSD,/USDEUR

GBPAUD,/AUDGBP

GBPCAD,/CADGBP

GBPCHF,/CHFGBP

GBPEUR,/EURGBP

GBPHKD,/HKDGBP

GBPJPY,/JPYGBP

GBPNZD,/NZDGBP

GBPSGD,/SGDGBP

GBPUSD,/USDGBP

HKDAUD,/AUDHKD

HKDCAD,/CADHKD

HKDCHF,/CHFHKD

HKDEUR,/EURHKD

HKDGBP,/GBPHKD

HKDJPY,/JPYHKD

HKDNZD,/NZDHKD

HKDSGD,/SGDHKD

HKDUSD,/USDHKD

JPYAUD,/AUDJPY

JPYCAD,/CADJPY

JPYCHF,/CHFJPY

JPYEUR,/EURJPY

JPYGBP,/GBPJPY

JPYHKD,/HKDJPY

JPYNZD,/NZDJPY

JPYSGD,/SGDJPY

JPYUSD,/USDJPY

NZDAUD,/AUDNZD

NZDCAD,/CADNZD

NZDCHF,/CHFNZD

NZDEUR,/EURNZD

NZDGBP,/GBPNZD

NZDHKD,/HKDNZD

NZDJPY,/JPYNZD

NZDSGD,/SGDNZD

NZDUSD,/USDNZD

SGDAUD,/AUDSGD

SGDCAD,/CADSGD

SGDCHF,/CHFSGD

SGDEUR,/EURSGD

SGDGBP,/GBPSGD

SGDHKD,/HKDSGD

SGDJPY,/JPYSGD

SGDNZD,/NZDSGD

SGDUSD,/USDSGD

USDATS,/ATSUSD

USDAUD,/AUDUSD

USDBEF,/BEFUSD

USDBRL,/BRLUSD

USDCAD,/CADUSD

USDCHF,/CHFUSD

USDCNY,/CNYUSD

USDDKK,/DKKUSD

USDESP,/ESPUSD

USDEUR,/EURUSD

USDFIM,/FIMUSD

USDGBP,/GBPUSD

USDHKD,/HKDUSD

USDIDR,/IDRUSD

USDINR,/INRUSD

USDITL,/ITLUSD

USDJPY,/JPYUSD

USDKRW,/KRWUSD

USDMXN,/MXNUSD

USDMYR,/MYRUSD

USDNLG,/NLGUSD

USDNOK,/NOKUSD

USDNZD,/NZDUSD

USDPHP,/PHPUSD

USDPTE,/PTEUSD

USDRUB,/RUBUSD

USDSEK,/SEKUSD

USDSGD,/SGDUSD

USDTHB,/THBUSD

USDTWD,/TWDUSD

USDZAR,/ZARUSD

Let me know if the data looks right to you, or if I'm doing this backwards. If you want the database, it is a 4 meg zip file, send me an email.

Wednesday, December 12, 2007

Monday, December 10, 2007

FOREX Trend Scan

Weekly

Notice anything? EURGBP is in an uptrend on all time frames.

Scans by the dozen

Here are some scans of the recent market activity, US only, I don't have enough time to do Canadian tonight.

Trending Scan

The first is a trending scan. The trend is your friend. If your into buy and hold, this is for you. These are leaders. Someone said to me once "follow the leader", I replied "sure thing, as long as they're going in the direction I want to go!" This applies to stock too. Here's a pic of the scan, click to get it from google thing-a-ma-jig.

Here is the "All-in-one-scan" that I posted when this blog first started.

Here it is.

Friday, November 30, 2007

The Never Ending Post; a FOREX Scrapbook

This post will go on forever. I'm going to keep updating it with tidbits of info I find on the net about FOREX or technical analysis of FOREX. I like to keep notes in point form, and if I need more, there's always Google. To read this really fast, read the red text until something catches your eye.

Best time to trade (Eastern Standard Time)

Only trade when there is a market open somewhere, or risk getting reamed by a dealer (of course this only applies to day traders and scalps)

- New York open 7:00 AM to 4:00 PM

- Japanese/Australian open 7:00 PM to 3:00 AM

- London open 3:00 AM to 11:00 AM

The best time to trade is from 3 AM to 11 AM EST. The New York and London trading sessions overlap between 7 and 11 am EST. The volatility is much higher and trading opportunities are much more frequent with bigger moves, especially in these four hours.

The currency pair that moves the most during these hours are the USD/CHF, then the GBP/USD, then the EUR/USD, then the USD/JPY. This is when you can make 30-100 pips trading in just a few minutes or hours.

Notes from a "TraderInterview"

- trade from 7am to 12 noon EST

- use trendiness, pivot points from previous day

- GBP - more range than EUR

- JPY - all over the place

- CHF - great trend and conservative

- stops at 15 to 30 pips

- 5 min. chart - reversal shows up here first

- 15 min - pattern direction

- 60 min - main trend direction

- 5min and 15min match direction pull the trigger

- FOREX is indicator driven

- Linear regression channel (LRC) - use on any time frame from daily to 4 hour

- LRC shows trend

- when price goes below LRC it usually snaps back quick

- weekly or monthly charts used to detect trend reversal

- 10am EST is a common time for a reversal for most currencies

- another reversal that is common is 11:30 am EST

- reversal will seek its first support level

Highest High & Lowest Low

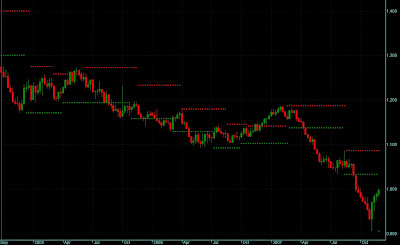

Here is an interesting chart of USDCAD that automatically plots the highest high and lowest low for a pre-defined period. I like the chart automation but I don't really like the pre-defined period. I would like to have a period that adjust automatically but I'm not sure what I want to use for the basis of the adjustment. I was think about using volatility like ATR or perhaps SAR to determine the look back period. The formula uses the moving average cross of the highest high and lowest low, that's why some lines are longer than others.

If you look closely and examine the chart, you can't really find a consistent pattern of support break through. I'm looking at the break through of support or resistance, specifically looking for a close above or below, and watching what happens to price.

The chart below has my special DOTS on it. This is a weekly chart. I'd say it still has some upward movement to work off. This week it briefly broke through the 1.00 level. About a month ago it hit 0.9054, what a profit that could have been eh? The weekly doesn't show any sign of this upswing weakening but the daily chart shows it's running out of gas. I'm going to wait for the downswing then jump on board.

A short using $2000 with 50:1 leverage at 1.0000 and covering at 0.9054 gives you some serious cash, not that this is possible but part of the move could be caught. The cash grab is about $10,000 for that move. It's nice to know the possibility. Remember, with this also goes that you could lose the $2000 just as fast. Practice risk management.

Monday, November 12, 2007

A quick FOREX trade

Today I looked risk in the eyes and shorted the USDCAD pair. The chart was screaming pull back. I used my developed signals to tell me when to pull the trigger, and actually ended up pulling the trigger twice, the first time taking a small loss.

The Word stated in a recent post "the Canadian dollar is in a power full bull trend". It is. However, looking at the chart, it seemed too powerful, it hit a low last month of 90 cents, great for Canucks living near the border, a quick 1 hour drive and save 20% on a new car, what a deal!! Maybe a car is not the best example because it sports miles and gallons, the old fashioned system based on arms and legs and feet, we use metric up here, based on water (I think?). I still get confused. Oh, back to trading.....

I was reading tradewhileworking blog earlier today and decided that it was time to find a little time to take on a trade, since I've not been able to trade for the past month or so. Great inspiration at his blog, how he manages to trade in a management role. I chuckle when I read about the issues he faces while trying to trade at work, it's familiar.

In the end I came out a couple of hundred bucks on top, but more importantly, played and learned with live dollars. At $2.50 a trade, I can afford to be wrong. I picked the right place for the stop, it got hit. Once USDCAD stopped climbing again, more signals showed up, on three different time frames, and I jumped in, setting the stop and the target in a bracket order. Then I shut down and drove home. Ate dinner, played with the kids, put them to bed, and turned on the 'puter. All right! Kicked 'risk' square in the balls. Moved the stop twice in and hour and it got hit.

The last few problems of my auto trading system are being worked out. I am inspired by reading about others that have their server located at the brokers, and they sit at home and check their account. Brilliant. If they can do it, so can I. The best part is, 'puters don't have emotions, that's why I'm so interested in a system. Low commissions too, the time is right. This is a revolution. If your a programmer, what are you waiting for?

Sunday, November 11, 2007

The fallacy of Canadian gold stocks

A few weeks ago, I was asked to post something about the Canadian dollar. The only thing I had to say about that currency was that it is in a powerful bull trend. Given that we may be at a critical point in the Canadian market, I wanted to "clone" the latest analysis I did on my own blog believing that this might be of interest to the readers of the TSX Trends blog followers. I would like to thank Brian for the invitation to post here from time to time.

Most people will believe that investing in Canadian Gold stocks is the way to participate in the rise of Gold. This is a myth. It is not true all the time. For this to be true, gold needs to rise, of course, and the economics need to be conductive to growth. Furthermore, value (the price of a stock) is created only is profit margins are stable or increasing when a commodity increases in price. When the price of the commodity or the price of profitability falls, the price of the stock will follow. I suspect that the costs to produce gold are rising faster than the price of gold thus creating pressures on margins.

Another falsehood that I have read on the Internet in the past month or so is some people finding precious metals somewhat “overbought” on a technical basis and thus recommending shorting Canadian gold stocks. That may be the right course of action but fundamentals are the right reason to short Canadian gold stocks not the price of Gold.

Agnico Eagle is currently trading at a double bottom support around $50.00. After reaching a high of $55.00, it has been building a triangle where the short term downtrend line has been resistance. The triangle was broken down and we have the potential for a sell signal which would also break the next short term uptrend line.

This set-up looks like the TSX composite index set-up of a few days ago. A break below the low of $47.00 would confirm an intermediary downtrend with 2 lower highs ($55 and $54) and 2 lower lows ($47 and $46).

The conflict between the fundamentals of a firm and the price of the commodity it sells is illustrated in the following chart which relates the price of the stock to the price of gold.

It is quite clear to me that fundamentals have taken over recently as investors are no longer willing to pay premium prices if they believe the economy is going into a recession.

This phenomenon is not unique to Agnico Eagle. Here is the picture for other Canadian gold stocks:

For those who prefer to invest in a diversified portfolio of Canadian gold stocks, the Barclay’s Gold iShares provided the following tracking error to Gold!

If you are using Horizon’s Gold Bull and Bear funds as a tool to participate solely in the rise and fall of the price of Gold, you will be sorry. This is tracking the performance of Gold stocks, not gold. You need to be aware of the fundamentals of the industry as well in order to make the correct bet.

And the correct bet may soon be available to you in a not too distant future. Wait for a breakout at $14.25.

There are two links on the right side of the page which will send you to Danny Merkel and Merv Burak’s web sites. They do a great job of following precious metals although Merv has another site where he posts his gold thoughts. I highly recommend these sites for a more thorough analysis of that sector.

In Conclusion:

Canadian Gold stocks have been leading the pack in the recent market uptrend. Even though the market appears to be topping into a new downswing, gold stocks have been resilient as their relative performance is still positive. That may be starting to change.

The Word

Saturday, November 10, 2007

The Q's

Here is my current system applied to the QQQQ. I have turned off all of the other lines, dots and stuff that clutter the chart and just left on the training stops that show when a buy and sell occured. I didn't participate in any of these trades. I find the system to work better on high volume issues such as the Q's and FOREX. I don't use volume in the system, but I do look at it when considering an order.

Amibroker Code - Zero Lag

I'm working on a bit of code that will plot a small line at recent high and lows in an attempt to highlight the "highest highs" and "lowest lows". I find that my eye doesn't catch that too quick, and that I have to stare at a chart for a while to determine what the trend is. I also know why I haven't learned to pick it up as quick as others, I don't "practice" enough. This is the main reason I'm trying to build a system, so I don't have to watch for trades all day long.... I can't anyways, I have a day job.

Here is some code I use called the "Zero Lag". I discovered this at amibrokerfan.com and modified it a bit. Enjoy.

When I post the code directly to the blog, the HTML screws up some of the text. Rather than figure out what the HTML switch is to post just text, I have posted the code to google docs.

Zero Lag Code

The World keeps me away

Over the past few years I have travelled to remote places within Canada and some foreign countries, a mixture of exotic and warm, rich and populated, and to various third world nations. The last place I happened to be was Panama.

Quick summary of the "look and feel" of Panama City: Poor nation trying to develop, US money is pouring in, the rich areas have a high Jewish population, perhaps baby boomers are looking to retire, I hear the weather is a allot like Miami the whole year around. It was too humid for me.

Monday, October 15, 2007

Caution taken while Auto Trading

One of the first things that I considered while formulating the basis for my automatic trading platform was risk. How would I place an order and not have to worry about my Internet connection or computer causing problems. I figured that I would let TWS do the risk management.

Using bracket order, I can send my orders to TWS and then on to IB's system. While my "system" is running here at home, the bracket order is continuously updated to move the stops and profit target. I don't really like trailing stops, so I don''t use them... for now. The worse that can happen under this scenario is that I get taken out of a trade. The second worst is that my profit target gets hit while price is moving up and the target has not been adjusted upwards.

I haven't been able to go a full day yet without some sort of bug or problem with the code, so I think this approach has paid off. It's only a paper trading account for now, but one day, I hope to have the auto trading working allot better.

Please participate n my poll on the left side of the blog page.

Sunday, October 14, 2007

The System, and auto trading

I have my system pretty much tuned for end of day and 1 hour FOREX (foreign exchange) charts. Why Forex? It's none stop data almost all week long, with no gaps (hardly). I started out using FOREX data just for testing, but lately I have traded it with success, although small success. I haven't gone full bore yet.

I have also been writing code for auto trading Forex through Interactive Brokers TWS platform, using Amibroker. I currently have a P3 laptop set up doing just that all day long. Windows Debug is also running, logging everything that happens. IB offers a 'paper' trading account, I'm using it for testing.

Technical analysis is an important part of my trading plan. To ensure I honour my stops, I figured that a auto trading platform would work well. It would not only get me in at the right time (defined here as buying based on signals and not emotions), it would also get me out on a stop that is pre-defined, without my second guessing. Since Forex is very liquid, placing stops on IB's TWS does not concern me. The stops aren't place at the typical levels either.

One of the things I had to do when setting up the auto trading interface was to draw out a block diagram, a decision tree. I go long and short (no up tick rule either). I discovered that there are many different things to watch out for while planning this out. Something as simple as exiting a position when I get a reverse signal, what to do?

I'm not ready to go live with the auto trading interface yet, but I have gone live with the system on a end of day time frame. In the coming weeks, I'll be posting screen shots of the system, as seen in previous posts, but tweaked with some new things on the screen.

To help me develop the system and auto trading platform I have been using Yahoo groups and Herman;s website, Amibroker.org/userkb, a great resource.

I'm interested to know how many readers have ever tried Forex and what their experience with it was?

Thursday, September 20, 2007

The Word has departed

Pierre "The Word" has moved.

As you have noticed, I haven't been posting all that much lately. I haven't even been reading the other blogs that I frequent. Just got married, not to mention a bunch of other things that seem to consume me for a while.

I want to thank Pierre for the effort he put into this blog, especially since I just had it up and running for a few weeks, he helped me get it rolling. It served as a good stepping stone for him to start his own operation. The more Canadian content out there in hyperspace, the better for us small people working the markets north of the border.

Pierre's blog is called "Canadian Point and Figure".

I encourage everyone to read it, he has been around the markets for a long long time, and offers great insight.

I have a question for Pierre, and a request. Perhaps he can celebrate the recent Lonnie action by posting a daily point and figure chart of the USDCAD and give us some comments.

The delicate matter of the loonie

It's official. I never thought I'd live to see it. The last time it happend was when I was a kid and Pierre was the Prime Minister. The dollar was at par with the USD today just after 2pm.

Friday, August 31, 2007

Trading System Update

Still working on my system using Amibroker. Here are a few things that I've tried, the work continues.

- I've incorporated Heiken Ashi charts for visual representation of trends.

- I'm now using a plug in dll for stops. It's called REM, and it's available on the yahoo Amibroker groups.

- I'm using FOREX data to test with since there are hardly any gaps. The downfall is that there is also no volume info available. But since I'm not using any volume related indicators, it's OK.

- Trying to incorporate the IB Controller plug in. It allows the buy & sell signals generated within Amibroker to transmit order to Interactive Brokers TWS application for placing orders. Wave files can also be triggered to tell you what is going on without watching the screen. It's not quite there yet. I'm using the paper trading account to test this functionality.

- I have incorporated signals from a Zero Lag indicator. It give similar signals compared to Stochastic but a bit earlier. I got this indy from Amibrokerfan.com. Mike, the admin, uses 5 indy's and Heiken Ashi charts for trading the emini. His system looks like it works but he doesn't advertise his loosing trades too much so who really knows.

- I continue to struggle with finding something that can do better than 5 to 10% CAR (compound annual return) . This may be some setting in my code to do with positioning size or something so I'll have to examine that.

The struggle continues. Overall, this is harder than I thought it would be. Hopefully I'll have something in a week or two.

Thursday, August 23, 2007

Chat

We have added a chat window on the left side of the blog. We welcome any suggestions for blog topics, or reviews of stocks, or sectors. I know "The Word" would like to have reader comments on his take of the market, or rather, what he "sees" in the charts.

If you have any experience or questions on trading systems, this is a great to place to discuss, much easier than opening comment windows.

I have seen some blogs with chats for day traders, to pass along stocks that are setting up or have begun a move. We welcome day traders to post through out the day.

Sunday, August 19, 2007

The Canadian market – Week in Review 32.

This week the TSX Composite broke through the 200 day moving average (13,327.04), then the March low of 12,661 and bounced back from 12,500 establishing a column of X which for now is a short term uptrend. I still don’t expect much from this bounce as there will be numerous resistance levels where supply will manifest itself, again.

-1- The first area of congestion will be the previous support at 13,250 (green rectangle) because broken support usually becomes resistance.

-2- For the short term trend to truly reverse itself, the market needs to break resistance at 13,650 (blue rectangle)

-3- The most likely scenario however would be the completion of an end of bull market distribution pattern called a head and shoulder, where the current rally would the formation of the right shoulder with a top in the area of 13,400 (purple square). The formation that I see here has been identified by the 3 purple arrows and the neckline would be at 12,500. I still believe we are now in a bear market. This long term trend will remain until the red bear downtrend line is broken (14,050 currently).

The TSE Bullish % is now valued at 36.94%, compared to a reading of 47.01% last week. This is bear market territory. For now, the bounce was not strong enough to change the bearish condition of most stocks in the index.

-1- Seven sectors had breakdowns as shown in the Last Event column compared to three last week. Metals and Mining and Energy moved from a bull to a bear trend joining Income Trusts and Healthcare.

-2- The bounce was lead by Metals and Mining, Energy, Finance and Materials (all are in a column of X).

The big event of the week was the breakdown of large cap stocks in Canada. The TSX 60 is now also in a confirmed bear market as show below.

There is no question that the Canadian markets are severely oversold, even after the recent rally. The legitimate question is what would convince me that this is a correction and not the beginning of a long term bear market. The answer lies in two indicators that are used side by side to confirm any short term uptrend.

The first indicator evaluates the number of stocks which are trading below their 50 day moving average. Currently 7.45% of the stocks are. There would have to be a breakout above the 30% resistance level (blue arrow) to confirm that the current bounce is more than a bounce.

In conclusion, the bulk of the evidence still favors the bears. The Feds handling of the liquidity crisis demonstrates to me how inexperienced Ben Bernanke has been in handling what may prove as a major economic event. He finally reacted to the pressure he received from his friends in the financial community. This may be a case of too little too late however. This week coming will be another lazy summer doldrums week!

The Word

therealword@gmail.com

Saturday, August 18, 2007

First kick at the can

Now, we all know that beck testing doesn't guarantee future results, but either does guessing, right! Software makes it easy for us to invent systems, test, tweak, modify... The system needs more work in terms of the results it spits out on the screen. I'll be running some more back tests once I have the stops worked out, looking to maximise CAR, minimise loser, and get the Sharpe ratio up there. More on this later.

Now, we all know that beck testing doesn't guarantee future results, but either does guessing, right! Software makes it easy for us to invent systems, test, tweak, modify... The system needs more work in terms of the results it spits out on the screen. I'll be running some more back tests once I have the stops worked out, looking to maximise CAR, minimise loser, and get the Sharpe ratio up there. More on this later.To the naked eye, this system looks like it is coming along just fine. What happens during sideways action? This...

I'll be attempting to fix this by killing buy signals as soon as the sideways is detected. More accurately, I have tried several things but I'm not satisfied yet. Perhaps a trade delay if Buy/Sell signals are too close together? The work continues..... But more importantly, I want to improve the stops. Looking at the chart, I know what I would do, by experience, judging how I have positioned stops in the past. I'd like to program the back tester to do some things that would give me a more accurate picture of what the capabilities of this system are.

I'll be attempting to fix this by killing buy signals as soon as the sideways is detected. More accurately, I have tried several things but I'm not satisfied yet. Perhaps a trade delay if Buy/Sell signals are too close together? The work continues..... But more importantly, I want to improve the stops. Looking at the chart, I know what I would do, by experience, judging how I have positioned stops in the past. I'd like to program the back tester to do some things that would give me a more accurate picture of what the capabilities of this system are.The next step will be to turn off the BUY and SELL signals and turn ON the SHORT and COVER signals, separately. Then, all the signals will be turned on the see if we have any interference issues.

I am focusing on a basket of stocks for now. Next, I'll test by price and volume, screening for liquid stocks probably more than 2 dollars. I'm not worried about exiting in terms of liquidity, I just don't like the choppiness of these types of stocks that trade under 100K per day.

The last part of this system will be to look at the markets for clues, to switch the BUY and SHORT signals ON and OFF.

In building any complex system, it is best to test all the small components of the sub-system separately first (Buy and Sell). Then test them as a whole system (Buy, Sell, Short, Cover). Then test that system together with other systems (markets, QQQQ, SPY, SPTSE, etc).

Friday, August 17, 2007

Get me out at any price

When one looks at the TSX 60 index (please look at chart below), which is a portfolio of the largest most liquid Canadian stocks available, using the traditional technical tools nothing really seems to have happened. The bull market uptrend line has not been violated so this must be a correction right? The 200 day moving average has been violated (MA 10 months) but that happened before in this bull market (blue arrows).

The S&P TSX 60 actually broke its long term uptrend line yesterday (O in a red square) as shown by the following chart. For institutions, that’s catastrophic:

The other significant event yesterday was that the TSX Bullish % (gold line) as shown on the next chart broke a significant multi year support (purple line with 2 purple arrows are the support and the red arrow is the breakdown) and there now is a good probability that we are going down to the 30% oversold level (green line). We just need to be patient.

The Word

Therealword@gmail.com

Thursday, August 16, 2007

Hedging – Now available in Canada

Hedging consist in protecting your portfolio by purchasing an asset which will be negatively correlated with your portfolio. Negatively correlated means that, when your portfolio goes up, the offsetting asset will go down and inversely. Up until recently, the only way to hedge was using options. For investors, it can get complicated and the leverage can be frightening. Horizon recently started offering a Bear ETF on the TSX60 index which for every 1% downside move on the index, theoretically the upside on the ETF should be 2%.

Lets suppose I am an retired investor needing income to live needing to protect myself against a market downturn. I own a diversified portfolio of income trusts yielding around 8%. My total portfolio is worth $200,000 and I am currently invested $100,000 in income trust and scared so I have accumulated $100,000 in cash yielding another 4.5% or so. I want to protect this income. What shall I do? Perhaps I should buy some Horizon BetaPro S&P/TSX 60 Bear Plus (HXD.TO) which if my portfolio goes down will rise and compensate for the capital loss.

The chart below uses the Barclay’s iUnits Income Trust Sector index Fund (XTR.TO) as a proxy for my portfolio and compares that to the HXD.TO from July 16, 2007 to last night. The Income Trust units (blue line) have been falling with the market while the Bear Plus fund has been going the opposite way.

If you want to be a purist, you could calculate the exact amount that would have been needed to offset the long position in Income Trusts. That would be $36,000 for a $0 capital gain. That must mean that the income trust sector is not falling as fast as the market.

Finally, what would have happened if we were very good at “market timing”. Then we would not have purchased the HXD.TO on July 16, 2007 but on July 23rd instead. The $50,000 HXD.TO bet would have provided a $11,000 capital gain or 22% on the $50,000.

Income Trust Income ($100,000) $08,000

Cash Income ($50,000) $02,250

Hedged portfolio Capital Gain ($50,000) $11,000

Total Return $21,250 or 10.62%

Not bad for a very defensive strategy in a DOWN market.

The Word

Therealword@gmail.com

Wednesday, August 15, 2007

Nowhere to hide

I worked in the finance business world for 35 years. One of the fallacies that I heard, and that I am still reading these days, is that one should buy precious metal stocks as a hedge to the dramatic downtrend world markets are going through.

The real truth is when the market goes down, everything goes down. That’s because, if the economic activity slows down, gold companies will be impacted just as much as any other sector of the economy.

XGD is an iUnit which is a portfolio of Canadian gold stocks. Does anybody remember when this portfolio reached a top of $86.50 December 5, 2006? It has been in a downtrend (red line) since then. How many times does one have to be alerted to exit when you are in a downtrend? There have been 5 such signals (red arrows) every time support was broken. There was a buy signal when resistance at $70 (blue horizontal line) was broken (blue arrow), and the ETF was severely shorted by the pros when it reached the downtrend line at $75 (open red arrow). It reversed to a column of “O” and it has been downhill since then. Nowhere to hide…

I for one would not put any of my money in Gold right now.

The Word

Therealword@gmail.com

Tuesday, August 14, 2007

Natural Gas is up 18.8% since August 6

The preferred strategy might be to purchase diversified income trusts with some natural gas exposure and a good institutional following. Bonavista Energy (BNP.UN.TO) which has a mix of 55% gas, 30% oil and 15% heavy oil gave me a buy signal today

Full Disclosure: I own a position in BNP.UN.TO and my position can change anytime without notice.

The Word

Therealword@gmail.com

Sunday, August 12, 2007

Update on scans

I'm (Another Brian) back from a one week vacation. Thank you to "The Word" for the detailed posts and market insight provided for the TSX. It is interesting how the TSX does not track the US markets step for step.

I am in the process of back testing some of the scans that I have previously posted here on this blog. In addition, I am working on a system that I will be back testing, and posting results of the back test. I have been educating myself on the back testing process, it can be as complex as you want it to be. The first thing I noticed is the similarity to simulation. I have programmed discreet event simulation at work for material handling systems and I know that exactness is not that important. The idea of simulation is to have data input parameters somewhat accurate and the results will give you a great idea of the systems processing capabilities. If you can provide rough input, you can expect the output to be at least 80% accurate in simulation. I recently viewed a presentation on back testing that was very educational, and although the stock market is far from simulating material handing, there are allot of similarities. I am using Amibroker to do this.

Here is a link to the files for these presentations. The files include 2 presentations, power point files, and sample files. I recommend anyone who is back testing watch these two movies, even if you don't have Amibroker.

Presentation 101

Presentation 201

There is a free plug-in for Amibroker called IO. It is used to speed up the optimization process of your variables. The videos also discuss the results, the goal to set for results, what your goal should be based on (CAR, Sharpe, Ulcer, etc), the process of walk forward back testing, and tons of other good information.

For those of you interested in learning more about Amibroker, here are a couple of links. Yahoo also has a few groups.

Amibroker main site

Amibroker forum - a separate website, called amibrokerfan.com

I probably will not be posting regularly since I will be working on the system. Perhaps I will attempt to optimize the scans I have posted. I must first learn how to use this back tester and understand all of the information it provides on the output.

The Canadian market – Week in Review 31.

This week the TSX Composite broke the June and May lows and might just be on its way to the March low of 12,661. On its way there, my best guess is that we may see a bounce around the 13,150 area but because this support is based on a single “O”, I would not expect much from this bounce.

As mentioned this week, the long term uptrend line and the double bottom support at 13,500 were broken down this week, and that puts the market in a bear mode.

I see a lot of red on the map.

We present below, an evaluation of all the sectors of the Canadian market. The significant events are:

-1- Three sectors, Metals and Mining, Materials and Income Trust had breakdowns as shown in the Last Event column. Income Trusts moved from a bull to a bear trend in the process joining Healthcare which has been in a bear for awhile.

-2- Technology and Utilities are now in a column of “O” leaving Consumers Staple as the only sector bucking the trend.

We added this week a table in order to monitor the MidCap, SmallCap and Gold sector of the market. As you can see, the TSX Composite breakdown was accompanied by a similar long term uptrend line breakdown in Small Caps which is now also in a bear market.

A chart of the TSX MidCap index shows that we are very near the long term uptrend line on this index. What will this week bring?

Finally, the chart below shows the SmallCap index breakdown discussed above.

In conclusion, I hope this review of the Canadian market from a Point & Figure perspective will complement the information you typically use to make your on mind on the future course of the market. That is the objective.

The Word

therealword@gmail.com