Here are two trades I'm in right now. These both appeared on the recent scans I posted. On the charts, green is a long entry, black lines are stops and targets.

Stops and targets are changed daily, these are the entries yesterday. Tonight I will adjust the stops and targets based on intraday charts.

The good, the bad, and the ugly will be updated once I exit the trade.

RIG

The good: Profit. 1% risk, followed entry rules, placed stop. The stop moved up the day after the trade to above break even. In the trade 3 days.

The bad: Profits taken too soon, but this was the plan. I haven't completed setting up my entire trade plan, specifically the exits. I have three target ideas - use MA's with a coefficient, use ATR, use a target that is only in reach in case of a huge gap up (unlikely), use resistance levels (could be far in the past, so perhaps too weak to worry about?) , don't use a target, only a trailing stop.

The ugly: Good lookin' trade, considering "the bad"

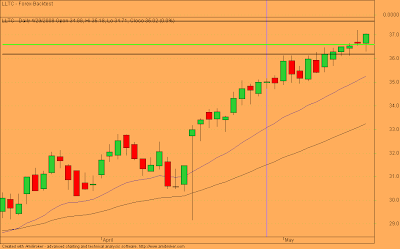

LLTC

The good: Still in the trade, moved stop to break even.

The bad:

The ugly:

In this post I'll give you some tools you can use to obtain videos, blogs, websites, books to help yourself. Make sure you follow the law and don't' abuse any copyrights. Your on your own, know what your doing and be responsible.

Videos

Have you ever watched a video online and wanted to save it to your hard drive? Most online videos these days are streaming, and they don't save to your "temp" directory like they did only a few years ago. Back then you could go to your temp directory and copy the file and re-play it. So what do we do now? There are two options, you can play the video and use a screen capture program similar to the ones these guys use on there blogs to make there videos at Alphatrends, Trade-Guild. The problem with this is you have to have the video player open and you can't do anything else while recording. Also, if there is a hang-up or delay in the stream, you going to record it. The better way is to use a streaming video capture program that captures the digital stream, behind the scene and while you work on something else.

I tried quite a few video download tools to find most didn't work well. The best one I have found is the cheapest, "FREE". It's called ORBIT and you can get your own copy right here. You can even schedule downloads and control bandwidth. So while you at work, where the bandwidth is HUGE, you limit the speed your downloading at so you don't raise any IT heads.

I have download videos from FXCM, Alphatrends, Optimize101 and 201 for Amibroker, MACDots system, all kinds of videos. I load them into my MIO UPS and watch them in the car on the way home from work. Well, I don't actually watch them, I listen to them. I also download mp3's from TrederInterviews and listen to them on the way to work/home.

Here is a portion of my library right now - click to enlarge. If you want some of these, I was thinking up opening up my FTP site. Depends on how many people ask for them.

Blogs and Websites

Have you found a website or blog that you want to spend time reading but can't find the time? Do you want to archive your blog? Do you want to save a copy of someone else's blog to your hard drive for reference? Do you want to save a website to your hard drive so you can read it while sitting an an aircraft? Here is the tool for you... your going to have to read the help a little to get the right results, it will only take 15 minutes or so.

HTTrack

Books

So you want to read some books. First off, don't go and buy them. Search Google for them. There and many PDF books out there, all you have to do is find them. Check these out, this is just part of what I have found. Once I find the book, I print it double sided, with 2 pages per side of paper. Instant book.

Go to Google and use advanced search.

Here is a sample page, make sure you use filetype to return only PDF's

Hope these tools help you. Let me know!

I have been taking a break, since work is keeping me busy. I am shifting, or rather opening up to other markets now. I have written a trading plan that includes the pairs I will ONLY trade in Forex. There are three pairs, non correlated and all USD's. I am also opening up to the TSX, trading the ETF's and highly liquid stocks. Prior to using IB, I was with E-Trade, this was a few years ago. I found that the profits I made were all eaten with commissions, that to much, that money could have been in my pocket. Since switching I was intoxicated with the though of auto trading and switched to Forex. Well, here is my long term goal:

Trade the TSX with daily charts and intraday triggers, set up on TWS. At the same time, trade Forex intra day in small lots. As the same time, work on the automated trading system that will trade on a 1 hour time frame, from Monday to Friday, from 11pm to 8am EST.

Does anyone think I should share and post my trading plan?