Last week I caught a big move and rode it for a nice profit. It was the breakdown of EURUSD below 1.3450 area (support area on the daily chart and also going back to May 2009). Now its getting back to that area (revisiting, support becomes resistance) and I'm considering shorting again. The only thing that looks odd is the speed at which it has re-visited the area. It doesn't look so odd on smaller time frames. With proper risk management and appropriate stop placement this is worth a go since the reward (profit area) is quite far away when looking at the daily chart, 1.2900 area. Here's the chart... as I see it.

Here's the hourly picture. Watch out for early Sunday fake outs, including gap plays.

Sunday, March 28, 2010

EUR USD TRADE

Friday, October 30, 2009

HSI / MHI Hang Seng

I've been searching the web for blog posts and forums to gain insight into the HSI. It seems some of the comments are dated. If you trade this I'd appreciate any feedback or information you can offer (what doesn't work, what works) from your experience. Here is what I have learned thus far;

It's technical intraday chart looks very technical and normal, the daily looks like its on crack, gapping all over the place. The opening gap break out seems to work well, gap and run. I've been using the first 5 to 8 minutes to gauge the direction and strength. Then I bottom fish and take the breakout for my position and let it ride. Last night worked perfect, huge gains, sold when the upwards trend line broke.

I also only trade the "morning session" up to about midnight EST, then its bedtime. The "afternoon session" seems to have a mind of its own, like a different day.

The first half of the morning session moves and trends, the second half can be choppy, the range (ATR) increases too. Just before each session closes the price goes nuts.

I've read that the market is heavily manipulated by technical traders? I'm not sure what that means, it looks like it has some structure on the 1 minute time frame.

Questions for you if you trade this;

- What is your daily target (in points or dollars)

- What is your daily loss limit?

- Do you trade specific time of the market?

- Do fibs work? I have noticed they work somewhat, good gauge of a pullback but I generally don't count on them.

- Do pivot points work? My guess is not since the gaps are huge, perhaps weekly pivots?

Any input would be helpful for me as I am building my strategy and plan for trading this puppy.

I also open up the chat room just before the market opens, its been quiet. Anyone know of any chat rooms for the Asian market?

Sunday, October 18, 2009

EURUSD

The last post on EURUSD talked about some basics and a short update as price was playing with the trend line. I am currently long and I plan on holding for the ride.

WEEKLY CHART From the weekly chart we can clearly see that price has entered an "air" zone, there is no meaningful resistance on the way up to the top of the yellow box.

Daily Chart - Long History The last time price had to overcome resistance it popped through the orange trend line on the third attempt (yellow circle). Price followed the upward red trend line and is still following it. More on this line later on.... We just broke the blue trend line, and as it happens, on the third attempt just like the prior break. No we are into the yellow free air space.

Daily Chart - Closeup Price just broke through the blue horizontal trend line, on the third attempt, same as the last horizontal trend line break. The pullback after the breakout above the orange horizontal trend line came to the upwards trend line and the 50% retracement. Note that it did not come back to the orange trend line, indicating a strong upward trend following the red line. Keep this in mind when looking to enter on the recent break.

Intraday The yellow area is the S/R "zone" from the weekly chart. It looks like we are clear for now. A good area to place a but LMT order would be at 1.4790 to 1.4844 for a low risk opportunity.

What's next?

Breaking the upward red trend line - This would only mean that the rate of increase or rise in price has slowed. Once it breaks through, look for it to come back to it and test it, then fall. No telling when this line will break.

Pullback - look for a pull back to the upward red trend line or the blue horizontal trend line. The best choice might be whichever one of those area also lines up with a fib level and a round number. I might even load up more on a pull back.

Be patient and wait for the pullback. If you need some help with pull backs watch this Pullback Video.

Do you have a position right now? Are you planning on geting in on this move?

Monday, October 12, 2009

EURUSD

UPDATE

Looks like a false breakout to me. It could also be a shakeout but I dont think a shakeout is that easy in forex and given this is a well watched trandl ine, there are too many participants at this level to do that.

Original Post

I was looking at the EURUSD chart today, deciding how to play pair as it nears long term S/R. My son came into the room and asked me what I was doing. I explained the bar chart and told him that we could make lots of money if our prediction was right. I asked what he thought the chart would do, first taking no more than one minute to show him how prices bounces off previous S/R levels, showing him the trend lines and S/R lines I drew. His 30 second view into the future is attached below and I have to tell you, its as valid as any other.

I'm playing this as a breakout for one reason only, this level has acted as resistance four times already and there is upward pressure from a very long trend line. There are three outcomes I see in the next week or so;

1: Breakout and huge move to the upside because of the long term nature of the two trend lines.

2: Breakout and a failure within a few days, price will move back below the 1.4821 area in a classic 2B move and then tank over multiple weeks if not longer.

3: Price will bounce off this area and head lower, below the uptrend line, then we are moving sideways. until a low is broken.

BTW - I have used Tipster Trendlines to place my trades. Check out this AFL for Amibroker for placing error free trades. "Error free" refers to the task of placing the trade, it does NOT refer to a trading system. the AFL also offers a risk management tool.

In short - this is a great place to watch price and place a trade. In other words, don't waste your time trading in between S/R lines on your chosen time frame.

Not sure about the long term, I'm focusing on the weeks ahead. Just for kicks, I'm posting what a 9 year old boy thinks of this market.

Tuesday, June 2, 2009

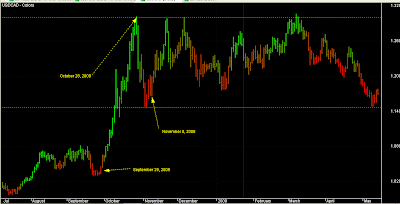

USDCAD - Trade update

Thursday, May 21, 2009

USDCAD - Look out below!

I've entered a short position in USDCAD. Why? Why not. The pair is at a major support level, a daily support level. I entered a few days ago, so I'm in profit and waiting to see what happens, and the best part is that I'm giving the market lots of room to move around, waiting for the decline.

Credit Crisis and PUT option

If you do some creative searching on Google, you will find that there were those that shorted the market using PUT options before the credit crisis was public. Click on the link above to get started. So here is what I'm saying, you might have noticed this happening, and allot of traders did. How many acted? Notice the forum article, the writer is trying to figure out why? Who gives a rats ass why. Keep that in the back of your mind, like a dart in your back pocket, take it out when you need it. If you saw the market take a shit kicking like it did on November 8, 2008, you might have thought to wait a few days for a bounce, and pick up some PUTs. Or, you might have not because you wanted to know WHY? and didn't make a killing like the traders who sunk billions into PUTs. So, why ask why?

Here are the charts. Notice the daily support level at 1.1463 TO 1.1350.

Monday, November 10, 2008

USDCAD Trade

By the way, go see Brant's videos at http://www.trade-guild.net/ if you want another view of the market.

Thursday, May 15, 2008

Trades

Here are two trades I'm in right now. These both appeared on the recent scans I posted. On the charts, green is a long entry, black lines are stops and targets.

Stops and targets are changed daily, these are the entries yesterday. Tonight I will adjust the stops and targets based on intraday charts.

The good, the bad, and the ugly will be updated once I exit the trade.

RIG

The good: Profit. 1% risk, followed entry rules, placed stop. The stop moved up the day after the trade to above break even. In the trade 3 days.

The bad: Profits taken too soon, but this was the plan. I haven't completed setting up my entire trade plan, specifically the exits. I have three target ideas - use MA's with a coefficient, use ATR, use a target that is only in reach in case of a huge gap up (unlikely), use resistance levels (could be far in the past, so perhaps too weak to worry about?) , don't use a target, only a trailing stop.

The ugly: Good lookin' trade, considering "the bad"

LLTC

The good: Still in the trade, moved stop to break even.

The bad:

The ugly:

Sunday, March 30, 2008

USDJPY Trade

Monday, November 12, 2007

A quick FOREX trade

Today I looked risk in the eyes and shorted the USDCAD pair. The chart was screaming pull back. I used my developed signals to tell me when to pull the trigger, and actually ended up pulling the trigger twice, the first time taking a small loss.

The Word stated in a recent post "the Canadian dollar is in a power full bull trend". It is. However, looking at the chart, it seemed too powerful, it hit a low last month of 90 cents, great for Canucks living near the border, a quick 1 hour drive and save 20% on a new car, what a deal!! Maybe a car is not the best example because it sports miles and gallons, the old fashioned system based on arms and legs and feet, we use metric up here, based on water (I think?). I still get confused. Oh, back to trading.....

I was reading tradewhileworking blog earlier today and decided that it was time to find a little time to take on a trade, since I've not been able to trade for the past month or so. Great inspiration at his blog, how he manages to trade in a management role. I chuckle when I read about the issues he faces while trying to trade at work, it's familiar.

In the end I came out a couple of hundred bucks on top, but more importantly, played and learned with live dollars. At $2.50 a trade, I can afford to be wrong. I picked the right place for the stop, it got hit. Once USDCAD stopped climbing again, more signals showed up, on three different time frames, and I jumped in, setting the stop and the target in a bracket order. Then I shut down and drove home. Ate dinner, played with the kids, put them to bed, and turned on the 'puter. All right! Kicked 'risk' square in the balls. Moved the stop twice in and hour and it got hit.

The last few problems of my auto trading system are being worked out. I am inspired by reading about others that have their server located at the brokers, and they sit at home and check their account. Brilliant. If they can do it, so can I. The best part is, 'puters don't have emotions, that's why I'm so interested in a system. Low commissions too, the time is right. This is a revolution. If your a programmer, what are you waiting for?