I have been using two charts with one set for buys and one set for sells. The idea was that the sell trades could start even if the buys trades were active. I was hoping to see the drawdown controlled. Not sure why it doesn't work so well, I haven't spent much time examining that though. Most likely because CF holds losers and take profits quick (no runners).

I had another brain fart the other day. How can I manually control DD, and not sit and ‘hope’ price returns. As I was looking through the sub-forums at SHF to decide where to post I ran across varso using a 45 pip stop (MPTM). It seems to work for him. My idea is almost the same! We all know that trading with the trend is the way to go, but there are problems with that. Which time frame is the trend you should be following? The trend for CF should probably be the 240 or max the daily for a couple of reasons, first, CF uses a 240 stochastic, and second, when a basket starts, and depending on how many maxorder you are allowing, a price reversal could last a long long time.

Picture this - Price has been ranging on the daily for weeks and CF is happy to make Buys and Sells inside this daily range. Now you enter a few trades, I've notice 4 to 6 in a ranging market on the 1 hour TF or 4 hour TF then price snaps against you. CF enters more trades, price keeps ranging and snapping against you. "Snapping" is the term I use when price surges in the direction of the trend. In a downtrend, if you look at the chart you see price slowly drifting up, then all of a sudden it hits a level that everyone wants and BOOM, you have a lopsided market and price moves fast.So what I'm going to try is to limit drawdown by turning off Buys or Sells once price passes a certain spot or level.

Here is the research I did to arrive at the solution. I'm going to use AUDUSD charts as I have trades shown on it. Now remember, none of these trades had any drawdowns I couldn't deal with. The trade starts are marked with lines

Here is the daily, notice the daily trend is strong down - didn't matter, CF made coin. We'll zoom in after this chart.

Below is the hourly of the same pair

Both directions made money - look where the buys are made in this downtrend, pullbacks and consolidation. If the pullback is weak or the consolidation not strong what happens? You get hammered.

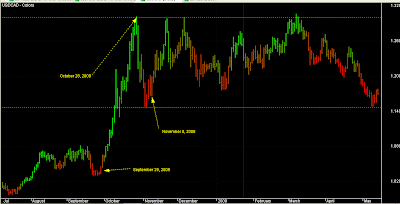

Here is a picture of what getting hammered looks like.

EURUSD Buys in a down trending market. This is the hourly - clearly headed lower. Everything looks good until the recent buy, notice the pullback was weak and we get smashed.

In this case - you could have drawn a line at the top of the range and call it "SellBelow", CF will only enter sell trade when price is under this line. In my version, I will also add to the logic, once price goes over this line all sell orders will be closed. Then get back to trading with a profit.

I don't know if this will work. I've looked at the trades CF makes (myfxbook charts the trades) and this approach should work. You could even follow the pivot points on the chart if you wanted too.

How would I prevent this? here is the idea.

Draw a line on the chart, a line in the sand. Actually, draw 2 lines. A green line and a red line.

Buys are only allowed ABOVE the green line, so you can trail it up if you want too.

Sells are only allowed BELOW the red line, you could trail this down if you wanted too.

One more thing - if there are open Buy orders and price drops below the green line, I close the basket.

So now I don’t have to worry about having two charts open, or having stupid large drawdowns. You could even use SAR as your trend switch here instead of lines, SAR is more automatic.

Back to the first chart - where to put the lines?

On the downtrend, I plan to use the red line and the green line on a 1 hour chart to start. The safe way to go in a downtrend, just turn off the Buy trades, chances are on your side that you wont get killed. You wouldn't even need these lines.

These are my Safety Lines.

So go ahead and draw the lines on the chart, the problem is if you change the timeframe CF needs to reload, I'm not sure if this is an issue or not. Go to a 1 hour TF, put the red line above the high that price would have to get to and make the strong downtrend weak.

Here's an example (yes, hindsight is 20/20)

The red lines I show, the bottom right of each line is "when" I would move the line

The green lines - as soon as the Buy (long) trades are started, I would move the green line. If you wanted “rules” – then as soon as the first trade is entered, draw a line. You have lots of time to do it before you get smacked.

The yellow box below shows you the current Buy trades that are getting hammered, and where this system would have exited.

If you are familiar with supply and demand you shouldn't have a problem with this. I'm going to try this and I'll keep you posted. I won't be near a computer for a few days, so don;'t expect quick replies!!! The code is NOT finished yet, maybe by the end of the weekend. I would like your thoughts on this method.