Amiquote is equipped with an automated download of FOREX from FORAM but only has the majors. I''m interested in USDCAD so this isn't the best solution for me. Yahoo seems to offer only current day. So I tried MSN. I used MSN to download EOD FOREX data and noticed that the USDCAD pair was inverted, as was the CADUSD pair. So I went the next step and obtained a list of currency pairs. I'll list the pairs and then some instructions on how to configure Amibroker/Amiquote to auto download. Some pairs included here are useless, so you might want to trim your database once you've completed this. Then I configured the Amiquote translation table to relate the proper data to the symbols the way it should look. Here are the instructions on how to do this.

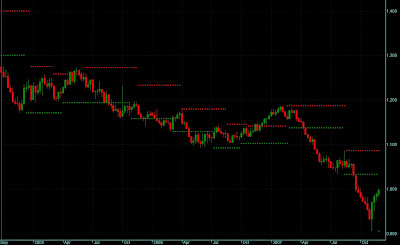

Here are the pairs, import this list into Amibroker. Import using "Import Wizard" select the file and set the window up like this screen shot.

Now you have a populated database in Amibroker, but it's empty. Next, click "Tools" "Auto Update", Amiquote opens. Select MSN as the datasource. In AMiquote Select "Tools" Symbol Translation", select "MSN Historical" and copy the following list to the clipboard and paste into the translation table in Amiquote as shown below. Hit OK and select the dates you want to import, then start the download. If you go to far back it will only give you monthly data, so do a long term and then a short term download. You can even try to get data for something like 2005 to 2006 and see if it give you finer resolution.

Copy this list into Amiquote translation table for MSN

AUDCAD,/CADAUD

AUDCHF,/CHFAUD

AUDEUR,/EURAUD

AUDGBP,/GBPAUD

AUDHKD,/HKDAUD

AUDJPY,/JPYAUD

AUDNZD,/NZDAUD

AUDSGD,/SGDAUD

AUDUSD,/USDAUD

CADAUD,/AUDCAD

CADCHF,/CHFCAD

CADEUR,/EURCAD

CADGBP,/GBPCAD

CADHKD,/HKDCAD

CADJPY,/JPYCAD

CADNZD,/NZDCAD

CADSGD,/SGDCAD

CADUSD,/USDCAD

CHFAUD,/AUDCHF

CHFCAD,/CADCHF

CHFEUR,/EURCHF

CHFGBP,/GBPCHF

CHFHKD,/HKDCHF

CHFJPY,/JPYCHF

CHFNZD,/NZDCHF

CHFSGD,/SGDCHF

CHFUSD,/USDCHF

EURAUD,/AUDEUR

EURCAD,/CADEUR

EURCHF,/CHFEUR

EURGBP,/GBPEUR

EURHKD,/HKDEUR

EURJPY,/JPYEUR

EURNZD,/NZDEUR

EURSGD,/SGDEUR

EURUSD,/USDEUR

GBPAUD,/AUDGBP

GBPCAD,/CADGBP

GBPCHF,/CHFGBP

GBPEUR,/EURGBP

GBPHKD,/HKDGBP

GBPJPY,/JPYGBP

GBPNZD,/NZDGBP

GBPSGD,/SGDGBP

GBPUSD,/USDGBP

HKDAUD,/AUDHKD

HKDCAD,/CADHKD

HKDCHF,/CHFHKD

HKDEUR,/EURHKD

HKDGBP,/GBPHKD

HKDJPY,/JPYHKD

HKDNZD,/NZDHKD

HKDSGD,/SGDHKD

HKDUSD,/USDHKD

JPYAUD,/AUDJPY

JPYCAD,/CADJPY

JPYCHF,/CHFJPY

JPYEUR,/EURJPY

JPYGBP,/GBPJPY

JPYHKD,/HKDJPY

JPYNZD,/NZDJPY

JPYSGD,/SGDJPY

JPYUSD,/USDJPY

NZDAUD,/AUDNZD

NZDCAD,/CADNZD

NZDCHF,/CHFNZD

NZDEUR,/EURNZD

NZDGBP,/GBPNZD

NZDHKD,/HKDNZD

NZDJPY,/JPYNZD

NZDSGD,/SGDNZD

NZDUSD,/USDNZD

SGDAUD,/AUDSGD

SGDCAD,/CADSGD

SGDCHF,/CHFSGD

SGDEUR,/EURSGD

SGDGBP,/GBPSGD

SGDHKD,/HKDSGD

SGDJPY,/JPYSGD

SGDNZD,/NZDSGD

SGDUSD,/USDSGD

USDATS,/ATSUSD

USDAUD,/AUDUSD

USDBEF,/BEFUSD

USDBRL,/BRLUSD

USDCAD,/CADUSD

USDCHF,/CHFUSD

USDCNY,/CNYUSD

USDDKK,/DKKUSD

USDESP,/ESPUSD

USDEUR,/EURUSD

USDFIM,/FIMUSD

USDGBP,/GBPUSD

USDHKD,/HKDUSD

USDIDR,/IDRUSD

USDINR,/INRUSD

USDITL,/ITLUSD

USDJPY,/JPYUSD

USDKRW,/KRWUSD

USDMXN,/MXNUSD

USDMYR,/MYRUSD

USDNLG,/NLGUSD

USDNOK,/NOKUSD

USDNZD,/NZDUSD

USDPHP,/PHPUSD

USDPTE,/PTEUSD

USDRUB,/RUBUSD

USDSEK,/SEKUSD

USDSGD,/SGDUSD

USDTHB,/THBUSD

USDTWD,/TWDUSD

USDZAR,/ZARUSD

Let me know if the data looks right to you, or if I'm doing this backwards. If you want the database, it is a 4 meg zip file, send me an email.