Tuesday, March 3, 2015

Monday, March 2, 2015

Tipster Trendlines Chart Trader - Properties

Wednesday, February 25, 2015

Tipster Trendlines (TT) is an Expert Advisor (EA) for MetaTrader 4 (MT4) trading software platform. Once you download and install the EA it will automate your manual trading for you. Tipster Trendlines is a TOOL, not a trading 'system' or robot. Use it if you place trades manually, it will do the grunt work for you. You can place every kind of order. You can select between 1 or 2 targets.

Tuesday, February 24, 2015

Tipster Trendlines for MT4 Update

Take a look at the videos and read about it at 2 different forums.

Here is the page that describes the MT4 chart trader expert advisor and give you the links and information you need.

Friday, January 30, 2015

Remember this post? Here we go AGAIN!

A long time ago, I did a post up on "What the top looks like".

If you trade forex and follow USDCAD, you will want to read this and keep your eye on the ball this time. Watch the freight train hit the 1.3 wall and STOP. Your guess is as good as mine if it continues or reverses, but 1.3 will stop price until all the order are sorted out.

Thursday, November 13, 2014

What to look for in a Forex broker

Use these suggestions to narrow it down to a few. It shouldn't take long to do that. The important thing to know is this – they are all out to take your money in fees of some sort. After you do some research you will see there is no perfect broker, they all have some way of getting the edge to take you money.

Step 1: Do some research

Before you compare brokers you need to list the criteria that you will compare. Add more to the list as you discover details. I used an excel spreadsheet to help me. List the brokers as you find them, filling in the details.

Regulation

There’s regulation, then there’s protection. Do not confuse the two. I want both. Is the broker regulated, and registered with the regulator listed on their site? If they are, also go to the regulators web site and cross check to make sure they are actually registered and in good standing. For US resident, good luck, the NFA and CFTC are pretty useless for forex, and in comparison the rest of the world, totally useless as there is no protection (refer to my post of CIPF which offers solid protection). I recommend a Canadian broker, if they let you open an account you have some real solid protection for your funds. Also, ask “is the money deposited separated from operational capital, in other words, is it segregated”? You want segregated.Dealing Desk, Non-Dealing Desk ECN

I like ECN, it’s a straight through process with less screwing with your orders.Spreads or commissions

Does the broker offer fixed or non-fixed spreads? Depends on how much you trade. Most MT4 brokers make money on the spread. There are many tools on the net to check this. How wide are the spreads? Check the tools and get a demo to confirm when you narrow down to a few brokers. Spread is more important if you trade short term.Demo accounts

Leverage and margin

Do they offer demo accounts? You need this to get familiar with the software and it will prompt LOTS of question if you actually place trades and follow through. How long until the demo account expires?Account lot size (mini, micro, standard). A smaller lot size allows you to trade with less money.

Swap or rollover

Does this broker credit or debit daily rollover interest? Some brokers either do both, deduct interest, or neither. This information is important to traders who hold positions overnight.Some even have negative swap both ways, meaning you have to pay them, how is this possible? If you want to do carry trades this will impact you.Trade rules

distance of stops, orders inside bid/ask, order types (brackets orders?), is hedging allowed?Currency pairs offered

What types of customer service is offered, and what methods can I contact them through?

What times are they available?

What trading platforms are offered? Is there a mobile application as well?

What is the deposit/withdraw process / methods?

Step 2: Compare brokers now that you have a completed spread sheet

Step 3: Open demo accounts and ask questions.

Pick at least two brokers that fits most of your criteria and open up demo accounts. Trade in different market environments. Learn all the different features of each trading platform. If you have questions, don't be afraid to ask. Many brokers have excellent customer service support and would be happy to answer your questions.

Demo accounts are great for selecting a broker. make sure you call them to ensure your demo account would be set up exactly as your real account. Same deposit currency, same rules (hedging, leverage, etc.)

Most demo trading platforms are very similar to their live counterparts, but not exactly the same. There may be a difference in speed of execution, slippage, and platform reliability (most of the time live accounts are more reliable than demo accounts). When you do have your strategy down and you are ready to move to a live account, start off small, test the waters, and see if this particular broker will suit your trading needs.

Media Monkey - Announce the next song title

Here is a sample of the transition and the song announcement.

It is absolutely fabulous!!

Do you want the script? All it takes is a small $15 donation to help me out.

The MediaMonkey website is here.

Tuesday, November 11, 2014

Monday, April 28, 2014

Play MP3 and have text to speech in MT4

- Talker - Text to Speech

- PlayMP3 - Play MP3 files in MT4

- TalkMP3 - Plays MP3 files and does text to speech in MT4

To learn more about these, visit the MT4 Talker and PlayMP3 page (link also appears at the top of the blog.

Demo is available.

Tipster Trendlines for Amibroker - new price!

It's now ON SALE

Now $30 - grab it while it's on sale!

What is Tipster Trendlines for Amibroker? Read all about it here.

Here is the FAQ

Sunday, April 27, 2014

Crossfader EA - Gold - Safety Lines

I have been using two charts with one set for buys and one set for sells. The idea was that the sell trades could start even if the buys trades were active. I was hoping to see the drawdown controlled. Not sure why it doesn't work so well, I haven't spent much time examining that though. Most likely because CF holds losers and take profits quick (no runners).

I had another brain fart the other day. How can I manually control DD, and not sit and ‘hope’ price returns. As I was looking through the sub-forums at SHF to decide where to post I ran across varso using a 45 pip stop (MPTM). It seems to work for him. My idea is almost the same! We all know that trading with the trend is the way to go, but there are problems with that. Which time frame is the trend you should be following? The trend for CF should probably be the 240 or max the daily for a couple of reasons, first, CF uses a 240 stochastic, and second, when a basket starts, and depending on how many maxorder you are allowing, a price reversal could last a long long time.

Picture this - Price has been ranging on the daily for weeks and CF is happy to make Buys and Sells inside this daily range. Now you enter a few trades, I've notice 4 to 6 in a ranging market on the 1 hour TF or 4 hour TF then price snaps against you. CF enters more trades, price keeps ranging and snapping against you. "Snapping" is the term I use when price surges in the direction of the trend. In a downtrend, if you look at the chart you see price slowly drifting up, then all of a sudden it hits a level that everyone wants and BOOM, you have a lopsided market and price moves fast.So what I'm going to try is to limit drawdown by turning off Buys or Sells once price passes a certain spot or level.

Here is the research I did to arrive at the solution. I'm going to use AUDUSD charts as I have trades shown on it. Now remember, none of these trades had any drawdowns I couldn't deal with. The trade starts are marked with lines

Here is the daily, notice the daily trend is strong down - didn't matter, CF made coin. We'll zoom in after this chart.

Below is the hourly of the same pair

Both directions made money - look where the buys are made in this downtrend, pullbacks and consolidation. If the pullback is weak or the consolidation not strong what happens? You get hammered.

Here is a picture of what getting hammered looks like.

EURUSD Buys in a down trending market. This is the hourly - clearly headed lower. Everything looks good until the recent buy, notice the pullback was weak and we get smashed.

In this case - you could have drawn a line at the top of the range and call it "SellBelow", CF will only enter sell trade when price is under this line. In my version, I will also add to the logic, once price goes over this line all sell orders will be closed. Then get back to trading with a profit.

I don't know if this will work. I've looked at the trades CF makes (myfxbook charts the trades) and this approach should work. You could even follow the pivot points on the chart if you wanted too.

How would I prevent this? here is the idea.

Draw a line on the chart, a line in the sand. Actually, draw 2 lines. A green line and a red line.

Buys are only allowed ABOVE the green line, so you can trail it up if you want too.

Sells are only allowed BELOW the red line, you could trail this down if you wanted too.

One more thing - if there are open Buy orders and price drops below the green line, I close the basket.

So now I don’t have to worry about having two charts open, or having stupid large drawdowns. You could even use SAR as your trend switch here instead of lines, SAR is more automatic.

Back to the first chart - where to put the lines?

On the downtrend, I plan to use the red line and the green line on a 1 hour chart to start. The safe way to go in a downtrend, just turn off the Buy trades, chances are on your side that you wont get killed. You wouldn't even need these lines.

These are my Safety Lines.

So go ahead and draw the lines on the chart, the problem is if you change the timeframe CF needs to reload, I'm not sure if this is an issue or not. Go to a 1 hour TF, put the red line above the high that price would have to get to and make the strong downtrend weak.

Here's an example (yes, hindsight is 20/20)

The red lines I show, the bottom right of each line is "when" I would move the line

The green lines - as soon as the Buy (long) trades are started, I would move the green line. If you wanted “rules” – then as soon as the first trade is entered, draw a line. You have lots of time to do it before you get smacked.

The yellow box below shows you the current Buy trades that are getting hammered, and where this system would have exited.

If you are familiar with supply and demand you shouldn't have a problem with this. I'm going to try this and I'll keep you posted. I won't be near a computer for a few days, so don;'t expect quick replies!!! The code is NOT finished yet, maybe by the end of the weekend. I would like your thoughts on this method.

Tuesday, April 22, 2014

Play MP3 sound files in MT4

If you are interested in this, send me an email. I can play mp3 files from MT4, it's easy!

Monday, March 10, 2014

Forex Trading Signal for MT4

Monday, June 3, 2013

MetaQuotes (MT4) - What are the alternatives?

Unfortunately, some third-party developers have hacked MetaTrader 4 trading platform’s network protocols violating end user license agreements and terms of contracts with brokerage companies.As a part of our active efforts to improve MetaTrader 4 system, we are starting to upgrade the network protocols and block all services based on the hacked versions.We urge you to cease any cooperation with ZuluTrade, Tradency, Tradeo, Myfxbook and other companies that use the hacked protocols violating our rights.

Hello,Hi Amibroker guys;I own version 5.4.I wanted to let you know that there is considerable pushback from MT4 users now – Metaquotes have done some stupid things, one of which is forced upgrades resulting in some not being able to access there account.You probably have heard of the rumblings since its your line of business, if not, here is a start....What this email is about is just to give you some thoughts....There could be a business opportunity for you, adjust Amibroker for the MT4 users who want to leave to another platform.. Some are considering cForex or jForex but those platforms aren’t quite right.The reason I don’t use Ami any longer to trade is the trading interface. I want data and a trading interface that is not clunky, it needs to be built in. I want to trade, not program interfaces. I traded with IB but found to much of the actual trade interface to be a pain in the ass. I wrote TipsterTrendlines, I know you have heard of it.You should give some consideration to connecting traders to brokers, the FXCM’s of the world. I don’t like the order2go plug in, or importing/exporting data. I like to turn on the software, the data comes in, the connection is made with the broker using programming from an expert (like you guys) and I do the trading. You could write a back end or use another platforms, maybe jForex, its open source, but I don't know anything about it (just suggestions)If you want to get more of a feel and some good feed back from some traders I suggest you sign up at SteveHopwoodForex. Friendly bunch of people who were fed up with ForexFactory so they started their own forum. I hope to see you there.Brian (AnotherBrian)

Thank you very much for your e-mail.

What I am planning is to release source codes for existing IBController with a free license to

create derivative works and some docs regarding

how to connect 3rd party solutions to GetTradingInterface function of AmiBroker.

This should provide enough ground for 3rd parties to add their own trading interfaces.

At the moment I can not promise that I will develop anything especially for MT4 users since

our resources are limited, and trading interfaces require lots of maintenance as brokers change their APIs.

But I think that opening sources for IBController may be good first step.

Best regards,

Tomasz Janeczko

amibroker.com

Tuesday, May 14, 2013

Hear the Market

A great way to study the market with the Market Pace indi.

This indicator was posted on FF and I've used it occasionally to "hear" the ticks. It's sort of like watching the level 2 screen but easier. Since SHF is where I usually go for forex related info, I thought I would post it there.

Set it up on a 1 minute chart and listen as price goes into supply and demand areas, or tests new highs and lows. It will sit there for a while then a big pop can be heard, the bigger the pop, the more points it just travelled.

As I don't tend to scalp very often I don't use this much but I do listen as I do other things sometimes. It sort of tells you when things are heating up....

If you scalp, you might want to try it out.

rooicol wrote this gem. I you have issues installing there are a few posts on FF that might help. Some users have had difficulties getting the correct sounds to play. Read the instructions and the posts on FF if you have issues. Feel free to post questions here as there are many brains willing to help.

It's attached here so you don't have to go get it.

Friday, May 10, 2013

Drawing Levels on MT4

This is a new script I wrote and have been using.

TT2P_DrawLevels

Drag and drop the script to the top part of the level you want to identify and it will draw two horizontal lines from that point to the right of the chart. If you drop it above current price it's red, below is green. So post on page 18 for a picture. If you turn on "show object descriptions" in the chart properties, the level will also show the timeframe where you found the level.

Tuesday, May 7, 2013

Monday, May 6, 2013

Questrade and MT4

Canadian broker Questrade now offers MT4. I don't have any info or details on the "rule set" but there is a demo available. If you sign up, use this promo code pa1ink35, you get some free trades (50 bucks) but I'm not sure that applies to MT4, it might only be stocks.

They are regulated by IIROC and your account would be protected by CIPF, and that's killer protection!!

Saturday, May 4, 2013

Money Management idea for MT4 EA’s

Lots of EA’s out there don’t place stops and the idea or risking a percentage of the balance isn’t really accurate. So you leave yourself open to more risk.

Here’s an idea that might help assuming your EA is profitable.

When an account grows and the lot size is determined by the risk value, the lots can get too big. Then the account gets hammered.

I know when I would kick this in for a demo but for a real account, would you really let it trade 1 lot? Maybe, but this way you can adjust it to your own appetite. This also lets you not worry to much about making withdrawals on time to gain back your initial investment or monthly withdrawals.

If you want to see the system performance and not colour the results with MM, use a constant lot size. The equity curve should be a relatively straight line. Then you use MM to curve it upwards. BUT, don;'t use MT4 to do this, it's not of ANY use.

To test this, start a demo and use a low lot size that would be lower than if your set the risk to 10. I would do this but I don't have any space for more demos. I might, however, try this add on to one of my existing experiments....

Then add your max lot size code and do another test.

Friday, May 3, 2013

The Spread in Forex (MT4)

I’m testing an EA called Crossfader (CF), this post discussed the spread as it impacts that EA.

Spreads are more on the exotics, less on the majors. This gets amplified in low liquidity So, my thoughts on exotics and the spread.....

Firstly, the CF biotch works great with EURUSD, the most proven and reliable pair. Hooking her up to an exotic? Why would you do this (other than a demo as an experiment), are you looking for a hidden treasure, are you subconsciously trying to ruin your account? That's purposely making your growth task much harder.

Slapping this EA on exotics and trying to then fix it with filters is a waste of time and increases your risk, not to mention work load and stress level (if live, not sure anyone is doing this yet...)

If you're trading live or planning to trade live at some time,

I recommend slapping it on the 6 majors, on a demo account. For analysing pairs.

Here's what I do, and consider I have a small nugget on a live test account with CF running;

Have 1 demo running 6 majors on all the time;

- Risk 10

- 100% DD

- check each week and month for each pairs performance. This will tell you what pairs to run live. [*]On MyFxBook you can analyse by pair.

Even put some additional pairs on it as you wish - The only purpose of this is to track pairs, not to see if the EA works or test DD or risk level, although you can glean some of this info from this demo

Spead Filters

- Let's say you are running biotch CF on EURUSD only.

Do you need a spread filter?

What number should it be set for?

Should it stop entries or entries AND exits?

Should it stop trading when spread is over or under your number (strange question right?)

When price is moving fast, like after a news event, is spread big or small? small, sometime there is no spread as there are so many trades going on.

When it's off hours and price is standing still, no bidders want to hit the ask, no sellers want to pay the bid, what happens? Large spread, price doesn't move, stalemate.

How about just before a news release? Wide spread, nobody wants to trade, they are waiting for the news. The market is open, lots of participants right? Nobody wants to trade.

wide spread = nobody wants to trade

What happens during market hours when price runs into daily support / resistance level? I bet most of you never watched a chart real time to see this.... As price approaches the level, you see many ticks, it slows as you arrive at the level, then you see nothing.... you check your internet connection, wtf? I lost my feed... then you see TICK.... the spread widens. This is where you want to enter or exit, a turning point possibly, or a breakout.

Don't believe me?

Run a spread recorder, install the market pace indicator so you can "hear" the market, and watch price on a 1 minute chart. Mark off area where price stalls.

Market pace is a nice piece - when price is moving slowly you hear a low volume tick pop sound. when price is at a level and stall, let's say price is rising, hits a level and stops. After about 30 seconds price will go down by the value of the wide spread, this larger movement makes a louder sound POP!!! It really is neat to watch this, it may help you understand the auction process.

Back to the questions above -

- Do you need a spread filter? entries, probably not if you turn the EA on for liquid session and use one of the majors.

What number should it be set for? use the spread recorder to find the right number.

Should it stop entries or entries AND exits? Probably both - apart from off market hours increasing spread, there are S/R areas and news events that increase spreads and I don't want to trade at that time, BUT - to get out of a trade at the profit level and worry about another pip, that doesn't concern me.

Should it stop trading when spread is over or under your number (strange question right?) This was the point of this post, now your thinking maybe I should enter when the spread is big during market hours? You must figure this one out on your own.

What am I doing? I'm adding a spread filter that just takes out the really stupid spreads, for example, EURUSD would not allow entry or exit on a spread of more than 4 pips. (that's actual pips, not fractional pips). Exotics, not trading them, those pairs are there for companies that do business in other countries, not for traders.)

Sunday, April 28, 2013

MT4 to Amibroker data feed and becktesting

We all know MT4 is a piece of shit for back testing (as well as some other things but lets stay focused!)

I want to test a system in Amibroker that has been written in MT4. First thing I’ll do it convert the code.

Then run it live in Amibroker with a data feed from MT4, to see if the same trades are opened and closed. This tell sme the code has been converted OK.

Next, I can back test it in Amibroker which has a robust back tester.

Here’s the plug-in to connect the two platforms.

http://www.marketcalls.in/amibroker/mt4-plugin-for-amibroker.html

Tuesday, February 12, 2013

Questrade offer MetaTrader (MT4)

Next step - What Canadian broker has MT4 and is covered under CIPF, and accepts USA or other countries?

I know that Questrade is going to be introducing MT4 in August some time.

UPDATE - They have MT4 now, here is the link

FXCM uses a company called Friedburg Direct, and the web site claims to offer MT4. I've sent an email to clarify, since I checked 3 months ago they did not have MT4 accounts in Canada (went to UK for MT4). I have a small FXCM account in UK. Here is the MT4 FXCM page.

I've looked at a bunch of brokers over the past week, I always look to see what country they are in. I found one in Mauritius (HotForex). I've been there. I wouldn't go with that broker with your money!! The broker would have to be in one of the large stable countries (with a half decent auditor!!!)

Alternatively, I'm looking at TradingStation II and Strategy Trader both offered by FXCM. I'm not using EA's except for TipsterTrendlines to place pending order. It's not an auto trading strategy, it's atool that does all the grunt work for my manual trades. So depending on what the next 2 months holds, I might go to that platform. After being hit by both MF Global AND PFG, I'm ONLY going with CIPF firms. There are to many f'n crooks in the finance world. The Canadian finance sector including banks are well regulated and offer a solid foundation, the credit crises really never screwed up our banks and real estate in Canada, not sure if anyone outside of Canada realises that.

So, I'm not saying that anyone should jump to Canadian firms, just that from my experience, any firm covered under IIROC and CIPF is well worth looking at in your comparison.

IIROC and CIPF

Protection and regulation are really two different things, depending on what you mean when you say “protection”. I define protection (for the purposes of this post) to be protection of my personnel funds in the case of another MF Global or PFG Best. Even if the regulator does not do their job (put your hand up American regulators!!!!) you will still get your funds returned to you.

In the unlikely event that the Member you are dealing with becomes insolvent, CIPF will ensure the securities, cash and other property that are held in your account are returned to you in accordance with our Coverage Policy.

Investment dealer insolvency doesn’t happen very often. In fact, since CIPF’s inception in 1969 there have been only 18 Member insolvencies. CIPF has made payments of $36 million, net of recoveries, and no eligible customers have suffered a loss of property.

So, for anyone outside of Canada (except AUSA residents), take a look at this page.... it tells you what and who is covered under CIPF.

http://www.cipf.ca/Public/CIPFCoverage/ ... olicy.aspx

Does it matter if I do not live in Canada, or if I am not a Canadian citizen or a Canadian resident?

No. CIPF coverage does not depend upon residency or citizenship. CIPF coverage is available to you when you open an account with a CIPF Member.

Sunday, February 10, 2013

Free Online Charting

Here is a list of online charting applications. They all run on your browser, chartingstation can also run on your desktop. I use the first one listed since it was the first one online and I’m used to it now. If I was to start fresh, I think I would go with chartingstation as they have less advertising on the screen real estate.

Take a few minutes and explore each of them. They are all free, free data from the BATSA exchange, meaning I wouldn’t trade intraday off those quotes but it gives you a great idea of where the market is. I mostly use it for my long term holding check, and to look at the US dollar index on the weekends.

In the end, pick one and stay with it.

http://www.freestockcharts.com/

by Worden brother. Although I like this, its heavy advertising and a push to upgrade or go with there platform TC 2000. I stay with the free version as it does what I need.

Community based, tons of features.

http://www.chartingstation.com

- Multi-screen end-of-day stock charting software

7 chart types (Candle, Point & Figure, Renko, Kagi, Heikin-Ashi, Line, High-Low)

16 drawing tools (Fibonacci tools, Gann tools, Channels, Andrew's Pitchfork, Text, Basic Shapes)

70+ indicators and chart transformations

Access 3 free stock data providers (Yahoo!, Google, MSN Money)

Load custom Comma Separated Value (CSV) files

Multi-platform: Windows, Mac OS X, Linux

Use from your desktop or web browser

Thursday, December 20, 2012

The end of the world

Friday, November 30, 2012

ProSLTP

ProSLTP Review

If your here you were probably searching for reviews of this tool, or the tool itself.

If you want a real free tool, go here and get TT2P.

The latest version is always on the first post.

Monday, November 12, 2012

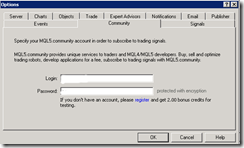

MT4 Signal Service

This last weekend I updated my platform to build 445. I'm running a FXCM platform on my smaller account. The update included a signal service from the MT5 / MT5 community. Here's the look of the new options tabs. Any comments on the new service? Here is the link to MT4 Signals.

Sunday, November 11, 2012

The sound of the market

Even if you don't find this Indicator useful for your day-to-day trading, it's interesting to listen to it for a while.

On Forex Factory, under the thread called "Scalping With Sound", I found this gem. (You'll have to sign up to get these files).

I installed this on the MT4 platform, on a Windows 7 machine. A little crazy to get it to work but I finally manage it. The trick was to select the new sound files, right click properties, and "Unblock" the files.

This is an indicator, so you put the "rooicol - Market Pace.ex4" file in the MT4/experts/indicators directory. Put the sound files in MT4/sounds. Then you re-start MT4.

Here is what I mean by "unblock". You need to do it for each file. It might work doing it once for the zip file after download.

Listen when the market is busy, I bet it sounds busy on a news release!

Friday, September 14, 2012

MultiCharts Discretionary Trader

MultiCharts was previously available for free, the catch is that trades could only be placed manually, no automation. It did however allow for chart trading, and it did a pretty good job at it.

You could place orders by clicking on the chart, with multiple targets. You could attach strategies such as breakouts or limit orders and as bracket orders as well. I didn't like the fat that it waited until the order was filled before it placed stops and targets (bracket).

The software has the ability to connect to a bunch of brokers as well, for order placement.

If your looking for this trading platform, you can probably find the torrent for it. I am fairly certain it still works as a free version to connect to a pile of brokers, but I'm not sure how buggy it is.

Thursday, August 30, 2012

How to program AFL in Amibroker and MQL for MT4

If you want to learn Amibrokers AFL or MT4 here are a few suggestions:

Take a night course in programming, not sure which language is close to either of these but if you ask in some forums or Google for similarities you’ll find answer. If you already know a language, don’t bother with school, jump to step 2.

You first need to learn logic flow and what functions are and what object programming means, your looking learn to the concept of programming and how you write a program, run it, and debug it. Then you can cross utilise this skill with any other language. It takes some self learning.

The next step, load up a small program and try to understand it. If you put your cursor on a function (which usually highlighted in blue) and press F1 help opens up and you can read about the function. Then read the help docs on program flow to understand how the program executes.

Next – load up a bigger program and understand the flow. Make some small changes, maybe try to print stuff to the screen or alerts menu, or send en email.

Next – read a tutorial, free one are always offered on line. You can start with this as step one as well but after you play with code you should go back to a tutorial and read it again. Read the tutorial once a week for 3 weeks, read it to understand it. Read it when the kids are in bed, you need to focus un-interrupted.

Next – have an idea of what you want to do, then steel some code as a starting point and modify it to suit your coding goal. here’s an example. Load up the stochastic indi. Make an indicator in one single window with 3 stochastic, with either K or D. Set them to 8, 21, and 55 periods. Run it on a 15 minute timeframe. Now add another that is set to a forced time frame of 4 hours and is an average of the 8, 21, and 55 periods. Plot the four lines. Use the same colour for the 15 minute and a thicker and different color for the 4 hour.

Then, ask yourself this – am I coding because I like it and trading is secondary, or am I coding for a purpose? I got into the rut of coding because it was a challenge. I wasn’t learning to trade. Then I decided to just watch the screen and price action and learn to trade. Then code for what I wanted to do.

And the best for last – I don’t think I have ever written a program from scratch – I always start with something that has been done already, then change it, add to it, delete stuff, and make adjustments. After a while there might not be anything left of the original, but it sure make it easier to start.