Warning: Buying a security in a long term downtrend is quite different than buying in an uptrend. NAL Oil and Gas is in a downtrend and therefore the probabilities that the trade fails are higher. Readers beware.

The Plan

As you know by now, I believe in having a plan for every stock I intend to own. The creation of such a plan starts with a Point and Figure chart analysis. That allows me to forecast a target price objective, evaluate when I will be wrong, and thus estimate a risk reward ratio.

NAL is clearly in a long term downtrend as shown by the red downtrend line. In April 2007, it reversed into a column of X establishing a support at $11.00 and a short term uptrend line (purple 45 degree angle line). It traded up to $13.50 and then backed down to the current price of $13.00.

From here, the price objective is a return to the downtrend line at $16.00 and it needs three resistance breakouts to get there (horizontal orange lines). The risk is a break of support at $11.00 to the red square of $10.50.

If this evaluation is correct, we have a return of $16.00 - $13.00 = $3.00 on a risk of $13.00 - $10.50 = $2.50 or a ratio of 1.2 to 1.

On the surface, the return to risk ratio does not appear that great, especially given that I require a minimum of 2 for 1 and prefer a ratio in the 3 to 1. I will address this problem when I discuss the trading tactics later on. But first, I want to evaluate the “fundamentals” of the company.

For this I use a long term monthly chart of all the securities that I follow. I believe that the long term trend line of prices is a good approximation of a companies’ growth rate over the cycle. Above this trend line I draw a parallel trend line in order to create a channel where most market prices should trade. There are times when a stock gets overvalued (see the over valued zone in red) and times when it comes back to the growth line (we are there now). My $16 price target appears conservative as it is within the expected trading band.

Finally, I also use the Fibonacci tool to evaluate the critical support level following any major correction (purple oval = $12.18).

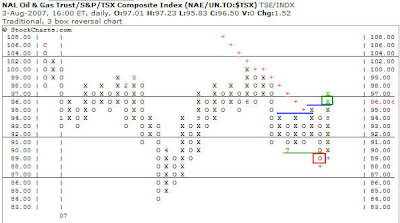

The second factor that I consider important is that a stock must have a relative performance better than that of the market. In order to evaluate that, I also use a P and F chart of the stock divided by the TSX index. The number therefore means absolutely nothing. There are two things that one must monitor with relative strength:

-1- Is the relative strength in a column of O or a column of X. NAE.TO = X

-2- What was the last event a breakdown or breakout? NAE.TO = Breakout

NAL Oil and Gas is therefore one of the rare income trust that I follow with a Breakout in a column of X.

The Trade

Converting a longer term plan into a trade becomes somewhat of an art and it always requires the identification of a stop loss if you are wrong in your assessment of the trade.

The art part is a function of the tools you use. It can be a screening system or a set of indicators which you monitor in order to time the trade to the best of your ability. I personally use the combination of an oscillator, volume indicator, and a non conventional convergence divergence indicator on different time frames as a confirmation for a trade.

In order to determine the right stop loss, I use a P and F chart with a 25 cents box size which I feel is more appropriate to the shorter term horizon of a trade. The chart below looks at NAL from that perspective.

Notice that the price column now increases by $0.25. Notice also that the resistance and support levels are different. Buying at $13.00 puts me in the middle of a trading range limited by support at $12.50 (green horizontal line) and resistance at $13.50 (purple horizontal line). The logical stop loss point on this trade is just below support at $12.25 (orange square).

So we now have a return of $16.00 - $13.00 = $3.00 on a risk of $13.00 - $12.25 = $0.75 or a ratio of 4 to 1.

If I hold this stock for one year, I will get a 14%+ return as income plus any variation from the price of the security in the marketplace.

An investor might evaluate his risk differently by evaluating the 0% return price which on this trade is around $11.00. That’s the price where, for the year, the total return would be $0 ( Price – Dividend or $13.00 - $1.92).

The Word

Therealword@gmail.com

http://tsxtrends.blogspot.com/

ReplyDelete